Before you call Artificial Intelligence a bubble, understand that bubbles are rare!

Exercise caution when calling something a market bubble. Bubbles are less frequent than commonly believed, and booms often persist longer than expected.

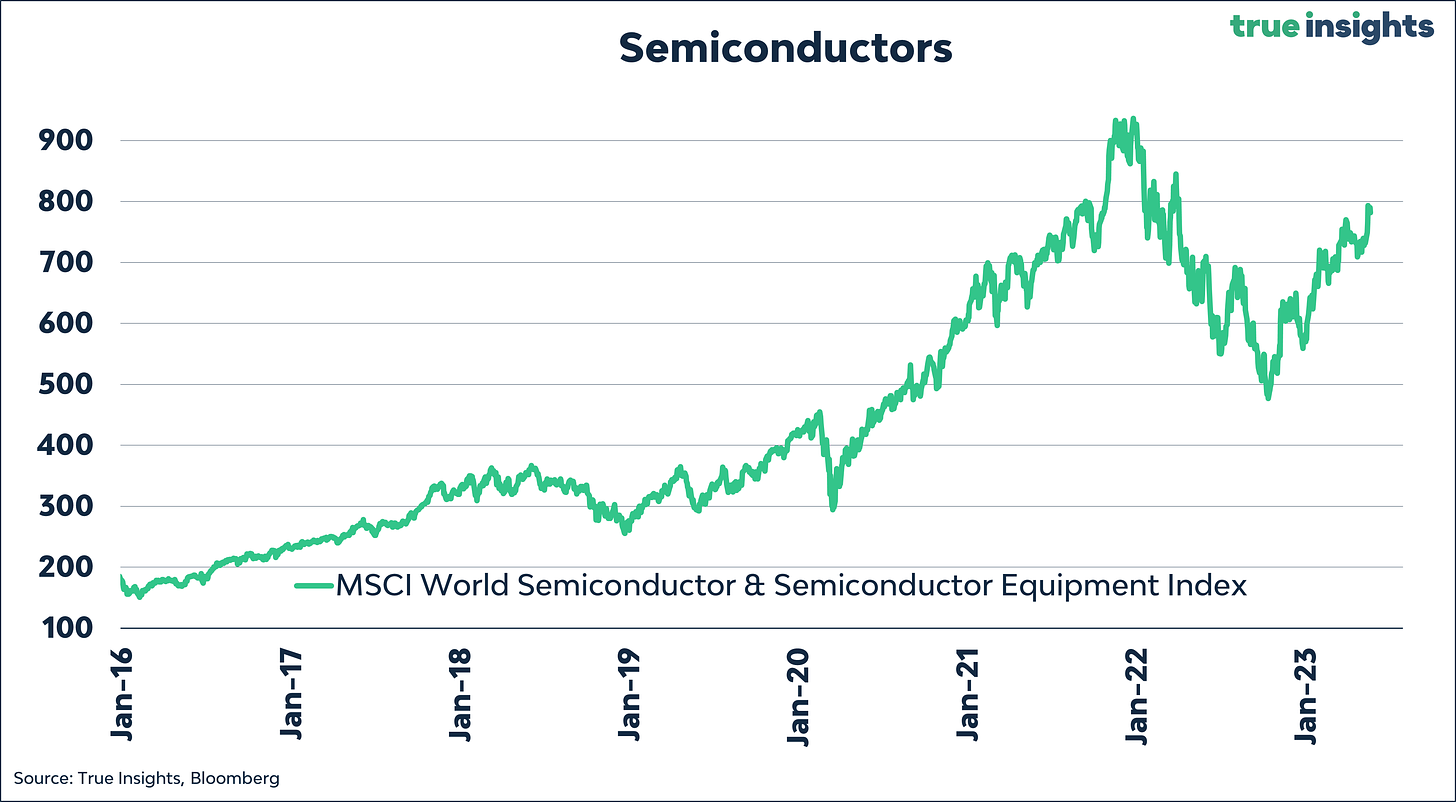

Is artificial intelligence the new Dot Com bubble? It may well be, but investors should feel somewhat constrained before calling something a bubble. Yet, unfortunately, financial markets are stuffed with gurus who incessantly perceive bubbles everywhere. What’s especially unfortunate is that these perpetual bears are often given a platform for years to express their concerns about an impending ‘bubble.’ But most of these anticipated bubbles never actually burst.

Using sound bubble data

And there is some quality data out there to back that up. Comparable to our approach to determine if we are in a systemic banking crisis, we use sound empirical analyses to make a substantiated call if we are in a bubble. And today’s Insight focuses on a relatively recent study on market bubbles from Goetzmann (2016), Faculty Director at Yale School of Management and Research Associate at the National Bureau of Economic Research (NBER.)

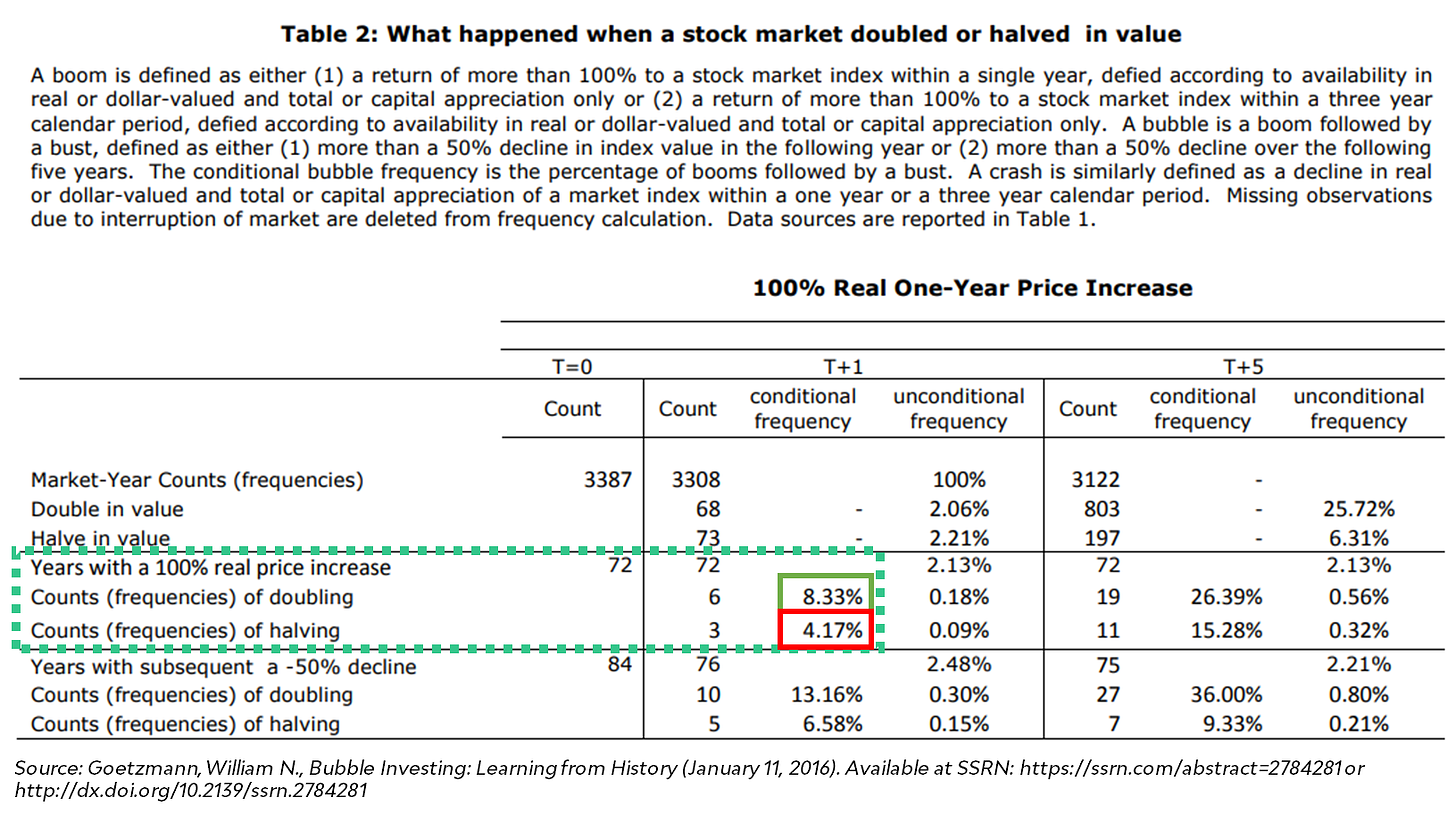

Goetzmann defines a bubble as a spectacular surge, a ‘boom,’ followed by a dramatic plunge, a ‘crash.’ In numeric terms: a boom is a real price increase of 100% within the span of a year, followed by a crash of 50% or more in the subsequent year. So, in that following year, all the boom gains are surrendered. That sounds like a reasonable bubble definition, right?

Bubbles are rare, while booms often persist

In total, Goetzmann studies more than 3000 annual stock returns, or market-years as he calls them, in 21 stock markets between 1900 and 2014. The result? Bubbles are scarce. Based on the definition above, the frequency of bubbles in the data is a paltry 0.3%. In addition, the likelihood of the stock market declining by 50% within a year after a rise of 100% or more in the previous year is only slightly more than 4%. Thus, bubbles burst within the next year in only one out of twenty-five instances! Moreover, and this will be hard to swallow for the perpetual bears out there, stock prices rose by another 100% within a year in over 8% of the cases. So, the chance of a ‘doubling after a doubling’ is twice as high as a ‘halving after a doubling.’

Hard pill to swallow

Of course, ‘bubble gurus’ are not so easily stumped. A commonly heard argument that gives them carte blanche to propagate the forthcoming crash for years is that bubbles may take a while to burst. To scrutinize this notion, Goetzmann also looks at what happens in a five-year period following a boom. Naturally, the chance of a crash increases, but even then, the probability of a bubble remains small. In 15% of the occasions on which the market increases by 100% within a year, the prices halve in the subsequent five years. But, once again, to the dismay of the perpetual bears, the likelihood that prices will rise another 100% is higher. In 26% of cases, another doubling occurred in the five years following a boom.

Conclusion

Based on these findings, some restraint seems appropriate when labeling something a bubble. Bubbles occur much less frequently than many investors assume. Obviously, genuine bubbles make a significant impression. When markets plummet 50% or more, this tends to linger in investors’ minds. Also, since there is usually ‘an obvious cause’ that can be identified retrospectively – think of the massive overvaluation during the Dot Com bubble or the excessive risk-taking in the Subprime mortgage mania – bubble memories tend to stick. But based on the work done by Goetzmann, the conclusion must be that major crashes after big booms are rare.

In our next Daily Insight, we will delve into the present market dynamics and their resemblance with past equity market bubbles. Stay tuned!

Sources:

Goetzmann, William N., Bubble Investing: Learning from History (January 11, 2016). Available at SSRN: http://ssrn.com/abstract=2784281 or http://dx.doi.org/10.2139/ssrn.2784281