Fed Lending Survey: ‘Stay away from High Yield Bonds!’

Fed Lending Survey + ISM Manufacturing Index = Less/Negative GDP Growth + Defaults, + Higher Credit Spreads!

Due to the recent abundance of incoming macro data, here is a quick recap of the key data points and their investment implications.

Let’s start with the July Federal Reserve Senior Loan Officer Opinion Survey, or SLOOS. As expected and already revealed by Fed Chairman Powell, lending standards have tightened further in the second quarter.

GDP growth down, potentially negative

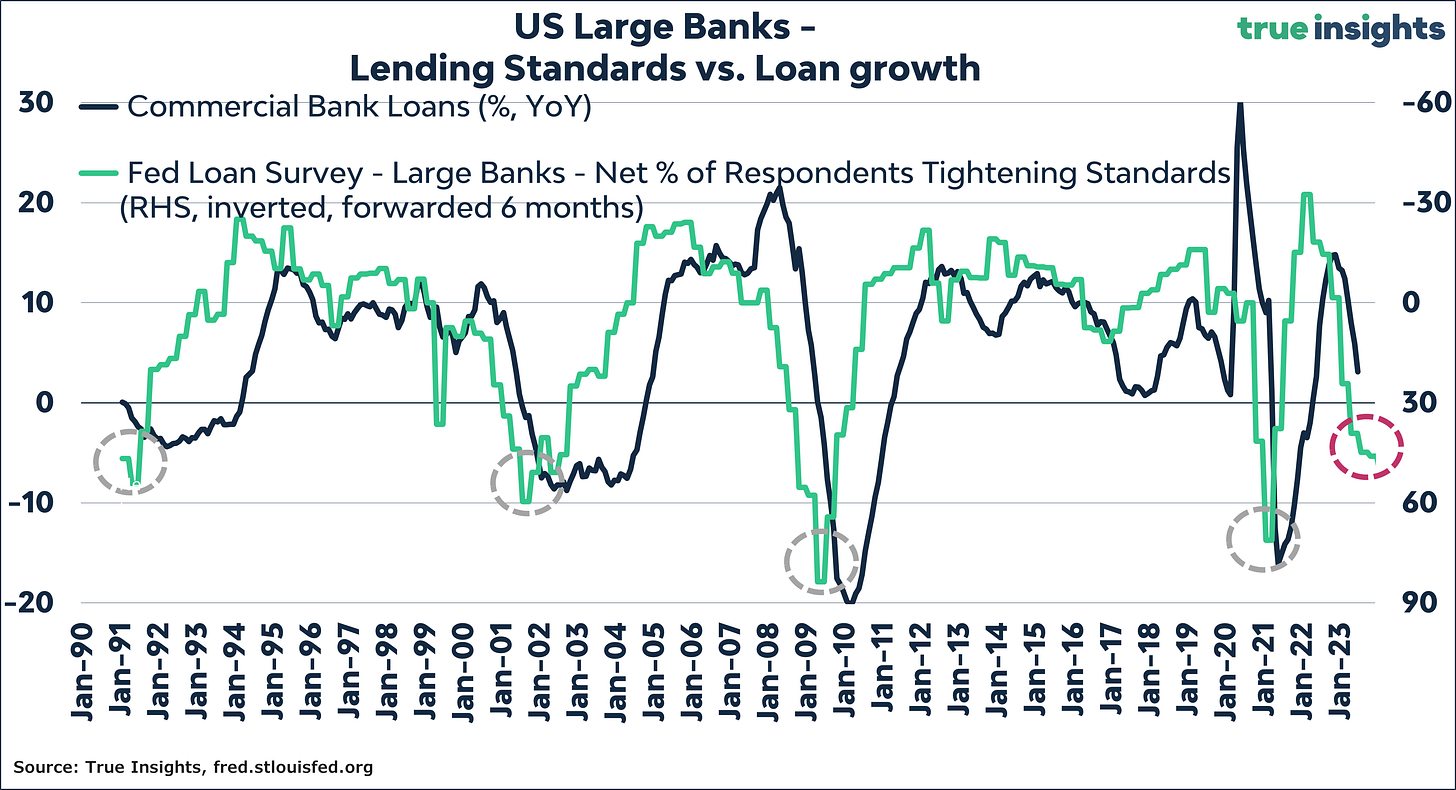

It will come as no surprise that tighter lending conditions are followed by a decline in loan demand. The graph below illustrates the correlation between lending standards and year-on-year loan growth. Additionally, bank lending growth based on the last six months has already turned negative.

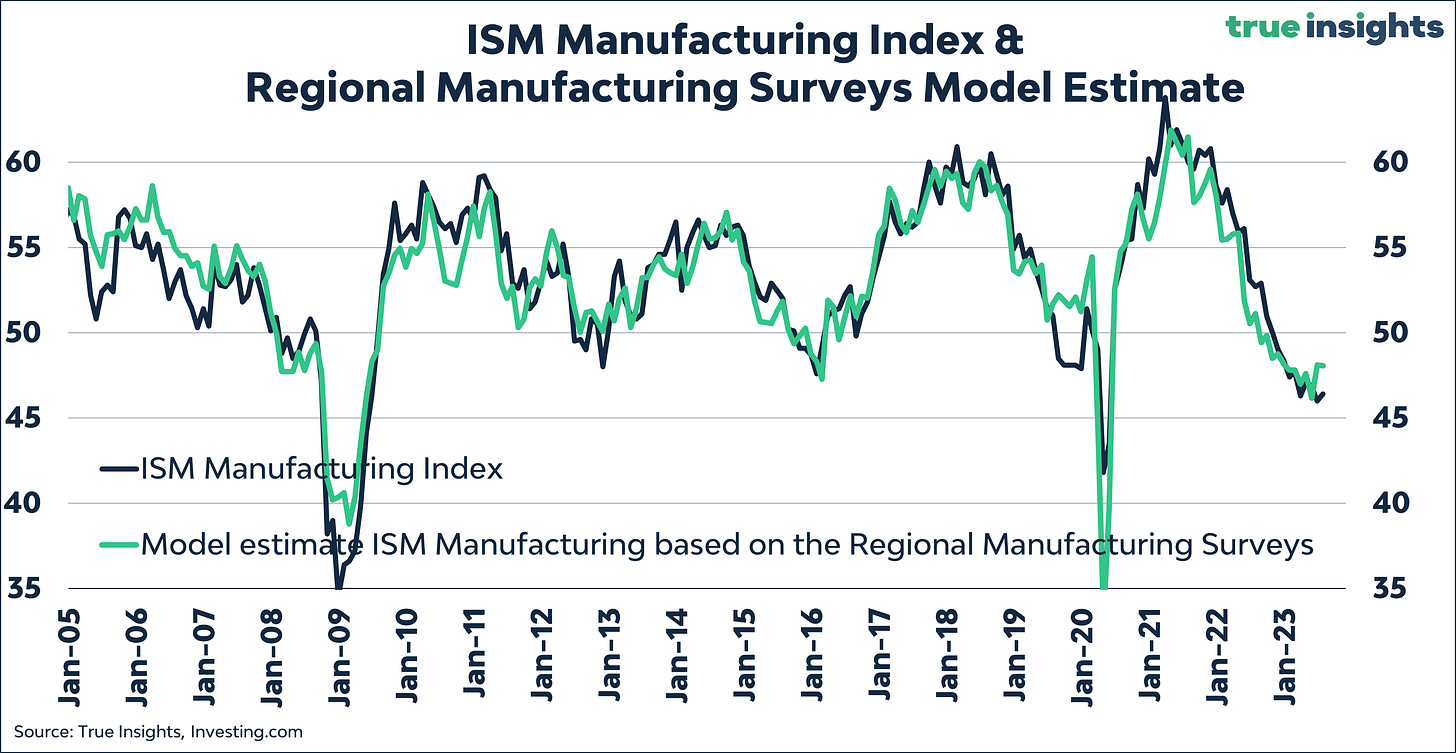

As we mentioned in yesterday’s Insight, a further deterioration in lending conditions bodes poorly for the ISM Manufacturing Index. Therefore, it is no coincidence that the ISM came in below expectations and remained at a tepid 46.4.

Finally, lending standards can be linked to US GDP growth directly. Year-on-year GDP growth would need to drop to -2.5% to align the two lines in the graph below.

Further tightening lending standards indicate an imminent and significant growth slowdown. Considering the level of lending standards (and the ISM Manufacturing), the likelihood of another recession is significant, though not 100%.

Defaults to surge

Tighter lending standards result, without exception, in an increase in bankruptcies. While we understand the narrative of companies locking in extremely low interest rates, this provides little solace when profits fall. And that is precisely what happens when economic growth significantly declines or turns negative. Based on the historical relationship between lending conditions and high-yield defaults, the latter is expected to rise to around 7.5% this year, nearly quintupling(!) compared to 2022.

The graph below shows that a faster measure of defaults, the Bloomberg Corporate Bankruptcy Index, which measures the ‘occurrence and severity of current and recent US bankruptcy activity for corporations with at least $50 million in reported liabilities,’ is already increasing significantly.

Do not Buy High Yield at these Spread Levels

Investors, driven by the strong market sentiment and fully embracing a soft landing scenario, have pushed high-yield bond spreads to fresh lows. High Yield spreads currently reflect ZERO chance of a recession and ZERO chance of default, diverging massively from tighter lending conditions. We do not expect these low spread levels to be sustainable.

The same applies to Corporate Bonds; the current spread levels misrepresent economic reality. The significant difference between the two asset classes is duration. The duration of Global Corporate Bonds is currently 6.1 years compared to 3.9 years for Global High Yield Bonds. Declining economic growth and the relatively strong performance of Treasuries after the end of the Federal Reserve tightening cycle provide Corporate Bonds with a larger buffer related to their longer duration.

ISM update

Once again, the ISM Manufacturing Index disappointed and remained significantly below the estimate of 48.1 based on the US regional PMIs, coming in at 46.4.

However, the underlying picture presents a somewhat less downbeat picture. For the second consecutive month, the gap between New Orders (higher indicates more growth) and Inventories (higher indicates less growth) was positive, suggesting a slight recovery of the ISM in the coming months.

The ISM New Orders Index itself rose to its highest point in 10 months.

Changing the Narrative?

On the other hand, the ISM Employment Index declined to 44.4, the lowest level since July 2020. This indicates a weaker US labor market, of which we have seen little evidence so far, but the recent decline will also provide valuable information regarding market sentiment.

A weaker labor market is Powell’s great desire, which further increases the likelihood of the end of the tightening cycle. The end of Fed rate hikes has been a dominant market driver in recent months.

However, history shows that unemployment tends to increase only after the Fed is finished tightening, and that larger tightening cycles have ended in a recession on nearly all occasions. If incoming macro data confirms the weakening in the US labor market data, it will reveal which narrative investors are willing to follow next.

In the short term, this has little impact on the ISM-based outlook for stock markets, which remains negative. The combination of a sharply rising S&P 500 Index and an ISM of 46.4 remains an outlier with downside risk attached to it.