Nvidia: A Quality Stock that Proves Investors Can’t Discount Exponential Growth

It's a myth that media-hyped stocks like Nvidia are unable to add to a quality stock-selection strategy.

I just wrote a blog for The Market Routine about Nvidia’s earnings and what it tells us about investor psychology and behavior. As an honored customer, I will send you these (and other blogs) within the True Insights research offering. Enjoy!

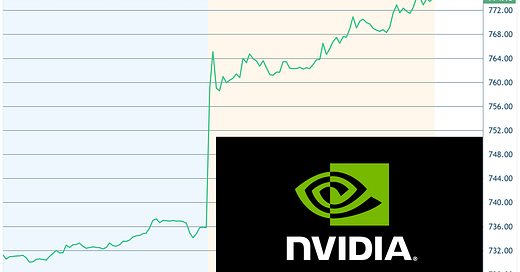

It’s both naïve and painful, but across X and LinkedIn, I’ve stumbled upon numerous posts where (professional) investors were dead certain that Nvidia would take a hit after its earnings release, no matter how great the numbers. However, as I write this, Nvidia’s stock price has soared by an impressive 13% from yesterday’s close. There have to be some career-limiting repercussions tied to these misjudgments, right?

Grasping Exponential Growth

Let me be clear: I’m no expert in stock picking. If you were to ask me about Nvidia’s earnings this quarter, or any company for that matter, I’d be at a loss. I suspect many investors are in the same boat, but that’s beside the point.

What I do understand is the challenge people, and therefore investors, face in valuing an asset, in this case, a company, experiencing exponential growth. Partly because we have been told so, starting in school, we perceive growth to be linear. It’s been proven repeatedly that our brains aren’t wired to process exponential growth. I’m no exception. Back in biology class, I could never fully wrap my head around the concept of how rapid cell division leads to massive numbers.

In my view, human inability to truly grasp exponential growth is a key reason Nvidia continues to outperform expectations. Below, you’ll see Nvidia’s sales figures, revealing a shift towards exponential growth since late 2022. In just five quarters, Nvidia’s revenue nearly quadrupled, surpassing USD 20 billion last quarter. The catalyst behind this surge? Artificial Intelligence.

Nvidia = Quality

The second point I’d like to make is the erroneous characterization of Nvidia by many investors as an overhyped and expensive tech stock. While it’s true that Nvidia has become a darling among short-term investors for their myopic ‘strategies,’ such a view is narrow.

As a follower of my work, you are likely aware that I recently launched an investment fund, the Blokland Smart Multi-Asset Fund, which heavily invests in quality stocks. These are companies that dominate their sector, have significant competitive advantages, minimal debt, and are highly profitable. Nvidia checks all these quality boxes.

The chart below shows Nvidia’s total debt-to-total equity ratio compared to the S&P 500 Index. Nvidia carries significantly less debt. When comparing other debt ratios, such as against book value, Nvidia also ranks extremely well.

Moreover, the notion that Nvidia is excessively priced is incorrect. Below is the trend of Nvidia’s forward P/E ratio versus the S&P 500 Index. With a P/E just under 30, the stock is pricier than the S&P 500 Index, but it’s far from extreme, especially considering Nvidia’s exponential growth.

The Biggest Stock

Nvidia’s emergence as a quality stock is reflected in its weighting in the MSCI World Quality ETF, where the Blokland Smart Multi-Asset Fund invests. Following yesterday’s rally, Nvidia’s weight in the ETF reached 4.8%, compared to 2.7% in the MSCI World Index. Since the start of this month, quality stocks (in Euros) have outperformed the broader MSCI World Index by 1%, partly thanks to Nvidia.

Nothing Lasts Forever!

Of course, there’s always the possibility that investors might extrapolate the sustainability of Nvidia’s exponential growth – which happens regularly – leading to Nvidia underperforming. But with an outperformance of hundreds of percentage points against the MSCI World Index and the possibility of Nvidia eventually exiting the Quality Index, it is getting likelier every day that this quality stock will, on balance, add value to a quality stock selection strategy.