The last dance – Some well-intended investment advice!

As The Great Rebalancing goes underway, make sure not to be the last to make that journey!

The last piece I write for True Insights is obviously not a review of the past week. The other day, I gave a presentation to 25 Dutch asset managers titled “At the Intersection of Two Worlds.” The main theme of my presentation was that a select number of long-term trends increasingly determines short-term market movements. And that seems like a perfect topic to conclude with.

Liquidity Rules!

As I have shown regularly in my pieces, one factor increasingly determines market developments: liquidity.

For illustration, below is the 4-week change in Federal Reserve Net Liquidity (Fed Balance Sheet – Treasury General Account – Reverse Repo) plotted against the 4-week change in the MSCI World Index.

The Fed is not the only provider of liquidity.

The correlation between changes in the Chinese central bank balance sheet and price changes of most asset classes, not just stocks, is also high.

That means predicting the direction of liquidity is essential to predicting where the markets will move next.

And my take is that it’s going up! Despite three disappointing inflation reports, Fed Chairman Powell kept the door to rate cuts open with statements like:

Federal Reserve rates are significantly tight.

Inflation has come down significantly, allowing us to look at both parts of the mandate again.

Rate increases are very unlikely.

The ECB, which started raising rates last and fell further behind the curve before taking action, wants to go further. In a speech in Dublin, ECB Chief Economist Philip Lane said:

‘Keeping rates overly restrictive for too long could push inflation below target over the medium term.’ And,

‘This would require corrective action through a subsequent acceleration in rate cuts that could even require descending to below-neutral levels.’

If you analyze these sentences carefully, there is quite a lot of information to be extracted. First, despite prices skyrocketing due to extreme fiscal and monetary policy, do not expect the ECB to show any leniency for your loss of purchasing power. The ECB fears inflation will fall below the ‘sacred’ 2%. Something difficult to justify after a reasonably traumatic inflation experience. Finally, Lane clearly implies that the ECB will not hesitate to bring rates back to very low levels if inflation falls below 2%.

Besides these examples, there are countless speeches, statements, and interviews where central bankers make it clear that the central bank balance sheet must remain large.

Hence, buckle Up!

Governments are adding to liquidity. From the United States, France, and Italy to China, reports are abundant that budget deficits will continue to increase. And that in a period of positive economic growth. Countercyclical fiscal policy is truly DEAD! For example, the Congressional Budget Office forecasts that the US budget deficit will not fall below 5% of GDP in the next decade. That also means more liquidity through fiscal stimulus, especially considering that the Fed will very likely monetize a significant part of those new debts.

Michael Howell of CrossBorderCapital combines hundreds of liquidity indicators and, among other things, creates this insightful chart. Liquidity comes in cycles, and we are only a small way into the current cycle. This chart fits exactly with the charts above.

The Big Question

With 2021 and 2022 still fresh in mind, the big question is what the combination of large central bank balance sheets and infinite fiscal stimulus will do to inflation.

Will it be a repeat of the early 1980s?

I don’t think so. And the reason is technology. It has become a massive deflationary force that will push prices down. While I expect ongoing geopolitical tensions to lead to an upward price effect, the impact of technology cannot be denied. And that means that as long as central banks stick to their inflation targets, and I don’t rule out that they will raise them, they will have to ‘work harder’ to achieve that inflation. If you recall Lane’s words above, you understand what I mean. More liquidity, larger central bank balance sheets, and more inflation volatility.

The Long Term

This forms the basis of my long-term thesis. The reason central banks stick to 2% inflation, or perhaps even higher, is debt sustainability. With low interest rates and positive inflation, governments and central banks will try to stretch the growth-driven economic model as long as possible. This will have crucial consequences, forcing investors to adjust their investment policy and asset mix.

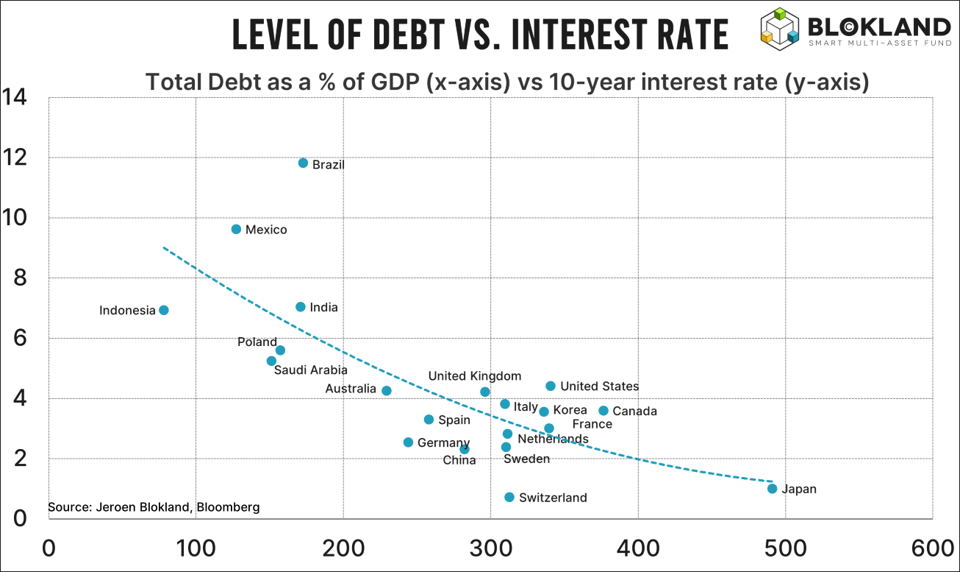

Lower potential growth means more debt

More debt means lower interest rates

Lower interest rates mean lower bond returns

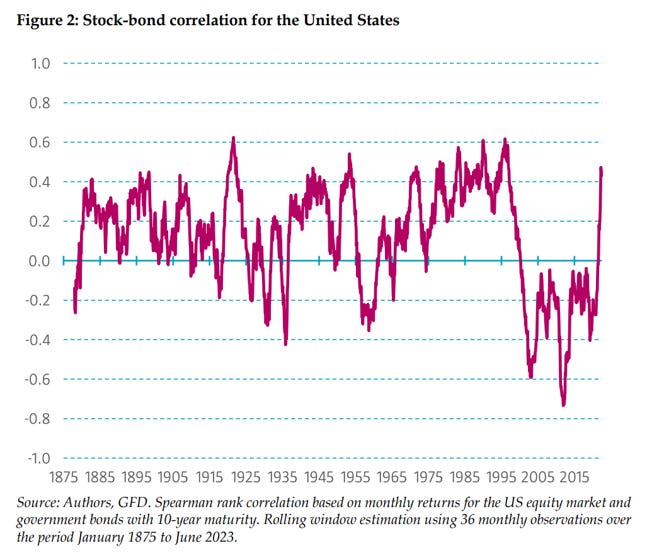

More debt means higher bond volatility

More debt means fewer diversification benefits with stocks, as bonds will be seen as intrinsically riskier.

These graphs will cause investors to diversify away from bonds. Think, for example, of the strategic portfolio construction process of professional investors, often determined based on some kind of mean-variance model. Imagine what higher volatility and lower diversification will do to the strategic weight of bonds?

What then?

Hence, this raises the question: Where should the 40% of the traditional 60-40 portfolio be put? The answer is conceptually simple. In a financial system increasingly dominated by an abundance of debt and fiat currencies, every asset that is intrinsically scarce becomes more valuable. The answer to debt sustainability is scarcity.

Given the history and size of gold, the yellow metal will likely be the first stop for most investors on the path to alternatives to bonds. I recently wrote the following about this:

Consider the total market value of all bonds included in the Bloomberg Aggregate Bond Index, one of the leading bond indices, holding a wide variety of bonds worldwide. It currently amounts to about USD 65 trillion. This compares to the current market value of gold, which is roughly USD 18 trillion. This means that the value of gold is about a quarter of the market value of all bonds in the Bloomberg Index.

Double Up

Suppose the market value of gold doubles – something I don’t rule out in the next, say, five years – while the market value of bonds remains unchanged. Then, instead of a quarter, half a dollar of gold stands opposite each dollar of debt. This relative increase in the value of gold can be seen as a market-driven, implicit form of a gold standard. It goes without saying that this would also reflect a kind of decentralized gold standard. Does that ring a bell?

Give Me More!

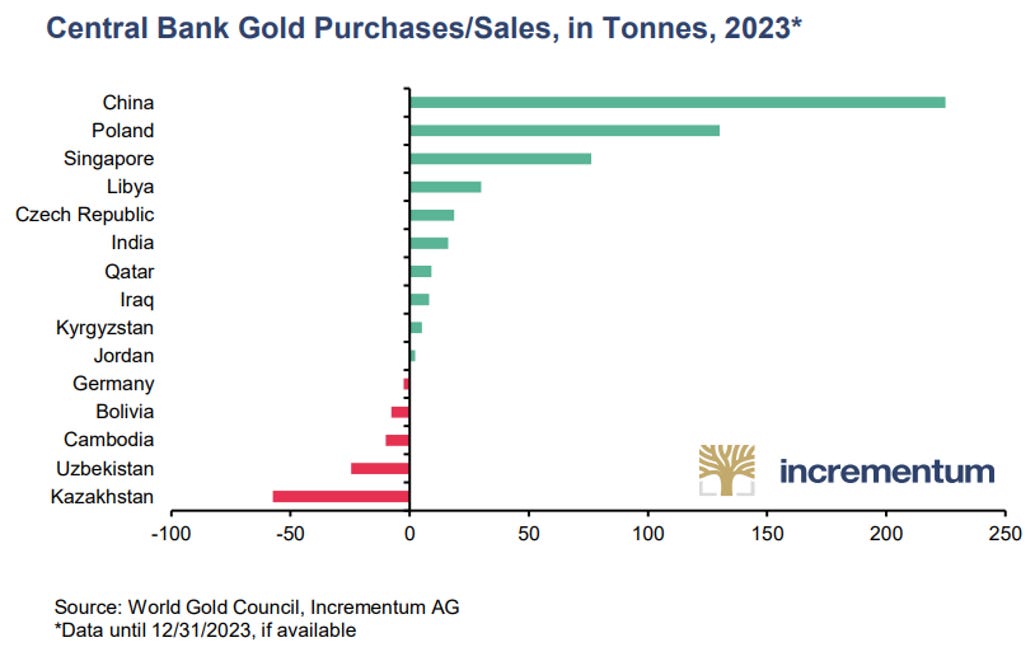

Let me substantiate my assumption that gold will double in price in the next five years, which is more straightforward than it may sound. It follows from several key trends driving structural demand for gold:

Non-Western central banks actively diversifying their currency reserves. Examples are Poland and Türkiye.

Countries like China and Russia, which are increasingly vocal about wanting to be less dependent on the US dollar, reinforcing the above trend.

And ‘yes,’ geopolitical tensions, which are in a structural uptrend, leading to increased demand for gold.

Chinese consumers buying vast amounts of gold as their property values decline and the Yuan is under pressure.

The ‘Gold Recycling’ theory, suggesting that while more countries prefer to trade in their local currencies rather than the US dollar, they will immediately convert those currencies into gold.

Western demand, like the Blokland Smart Multi-Asset Fund, which does not use gold ETFs, should not be dismissed as one of the driving forces behind rising gold prices. This demand reflects the large-scale rebalancing of traditional investment portfolios from fiat and debt-related assets to scarce assets.

A Future-Proof Portfolio

The above arguments show that ‘out-of-control geopolitical tensions’ are not necessary for a further rise in the demand for and price of gold. In addition, the last demand driver mentioned above (out of fiat into scarce assets) implies that gold is not the only asset class benefiting from this rebalancing.

Enter Bitcoin

In an increasingly digital world, where our money and debts are mostly digital, a genuinely scarce asset that investors (and savers) are willing to adopt as a store of value becomes compelling. At the current juncture, both gold and Bitcoin have merits, making a strong case for including both in a portfolio.

Bitcoin is uniquely scarce, even more so than gold, with above-ground stocks increasing slightly each year. Moreover, Bitcoin addresses two key issues:

The weakening relationship between money and trust. Trust in the traditional sense has become obsolete through its underlying technology, as every PC running a node can verify the ledger. Energy is the arbiter, keeping the ledger safe (immutable) by making it and the underlying blocks ‘heavier’ with each new block mined.

The settlement of the underlying scarce asset. People around the globe can transact almost instantly, but settling with a genuine store of value like gold can take hours if not days. With Bitcoin, the transaction includes the scarce asset verifying its value.

True Diversification Issues

My key investment belief for the coming years is the accelerating migration from bonds to alternative scarce asset classes, which is why I started my Blokland Smart Multi-Asset Fund.

However, the demand for gold, Bitcoin, and other scarce asset classes will also come from within the alternative investment universe. Over the past ten years, investors have been misled by all the sales pitches about Private Equity, leading to a disproportionate allocation to this ‘asset class.’

Take the example of Family Offices. Globally, they allocate almost a quarter (22%) of their portfolio to Private Equity. In the US, family offices invest as much as 35% of their assets in Private Equity. This is despite the fact that at least half of the investment case for Private Equity is ‘hot air.’

Because Private Equity is NOT less risky than stocks. The default story that Private Equity has lower volatility than stocks is simply not true. The reported lower volatility is the result of a valuation gimmick. Private Equity investments are valued at relatively large intervals. Concerning portfolios of Private Equity investments, only a part of the total portfolio is revalued periodically. In short, Private Equity valuations are ‘smoothed,’ with artificially low volatility as the outcome.

Let me show you what happens when you ‘desmooth’ Private Equity returns like in the table below from Venn by Two Sigma, a data science company.

The return on Private Equity was indeed higher than that on publicly traded stocks over the past 20 years. However, I wonder how beneficial it would have been after accounting for the costs and considering that the money is tied up for longer.

The ‘desmoothed,’ or actual volatility (16.64%), is 80%(!) higher than the reported volatility.

The desmoothed volatility is almost as high as the volatility of publicly traded stocks (here, the S&P 500 Total Return Index).

As a result, the actual Sharpe ratio, the return divided by volatility, is nearly half of what is reported.

Moreover, the correlation with the S&P 500 Total Return Index is quite high, at 0.87, indicating that these two investment categories almost always move in the same direction. For comparison, the correlation between stocks and gold & Bitcoin is generally close to zero.

The maximum drawdown, or the largest measured decline since 2001, is over 46%. This is much more than reported and also more than that of the S&P 500 Total Return Index.

Private Equity behaves very much like listed Equity, with the caveat that you will not be able to exit once markets tank.

Conclusion

I want to close this final piece with a direct piece of investment advice: include some intrinsically scarce assets in your portfolio. Perhaps not as rigorously as I have done with the Blokland Smart Multi-Asset Fund. Yet, as I have shown in this post, the likelihood of an attractive risk-return outcome for the traditional 60-40 portfolio has significantly decreased, building the case for alternative asset classes.

Reports about Michael Burry buying 7% of his portfolio in gold or Semler Scientific, a US medical risk-assessment company, announcing that it has adopted Bitcoin as its primary treasury reserve asset are likely to become much more common. Therefore, try not to be the last one to make the switch, as it might be too late by then.

Thank you again for all your massive support. To continue reading my work, please subscribe to the Blokland Smart Multi-Asset Fund newsletter (Nederlands here, ) and the Blokland Market Routine newsletter )

For more information about the Blokland Smart Multi-Asset Fund, please visit the website or contact me directly at jeroen@bloklandfund.com

Until we meet again!

Best regards,

Jeroen