The State of the US Labor Market – The Good, the Bad, and the Ugly

After another month of stellar job growth, what is the state of the US labor market, and does it allow for an end to the Fed tightening cycle yet?

The United States labor market continues to exhibit remarkable strength, despite a cumulative Federal Reserve rate hike of 5.0 percentage points. The fact that US employment remains so strong is not good for Federal Reserve Chair Powell and his colleagues, who seek a weaker labor market to solidify their conviction in defeating inflation.

The good

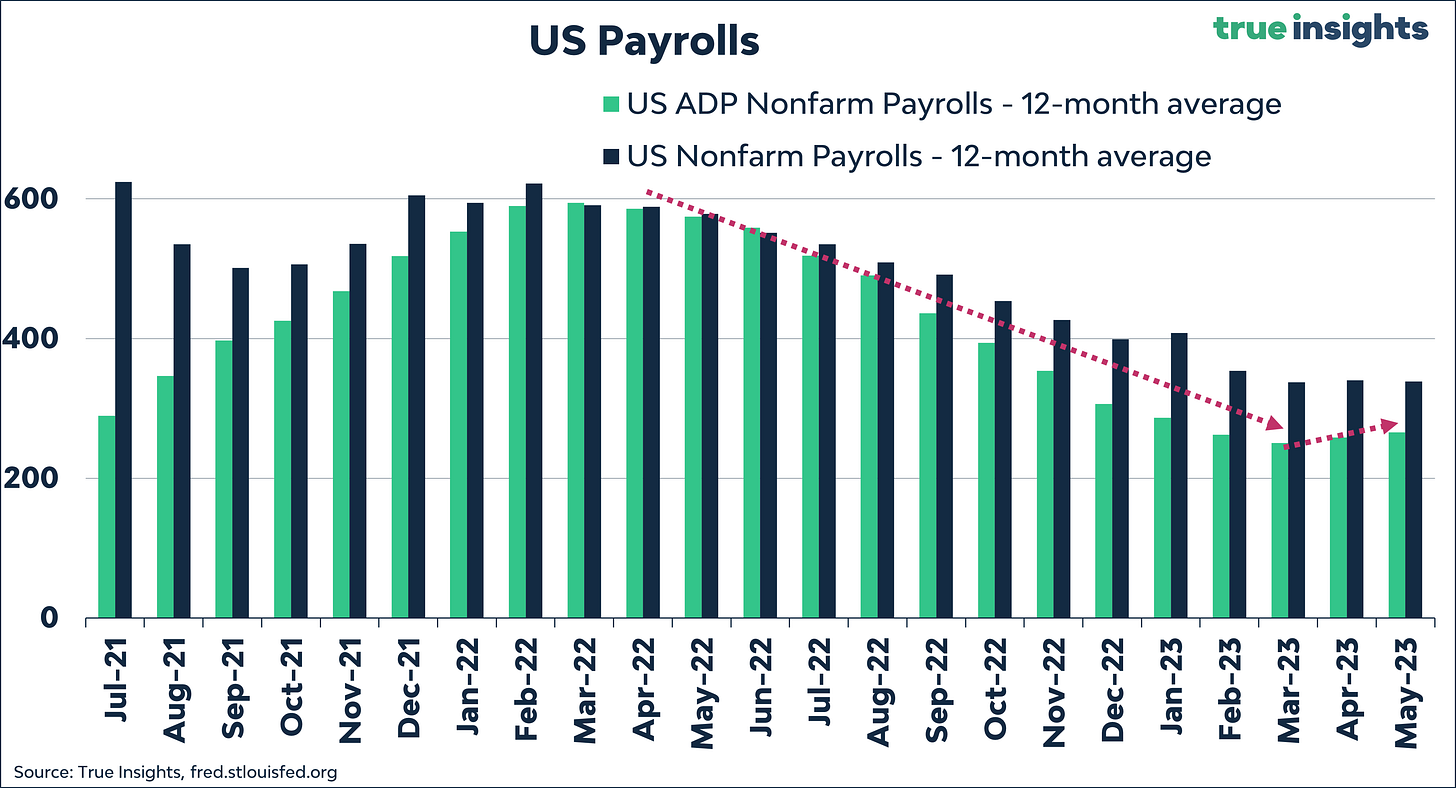

Payrolls witnessed a substantial surge of 339,000 jobs, surpassing expectations by an impressive 144,000 and marking the largest gain since January. Moreover, significant positive revisions were made to the data from the previous two months, reflecting an overall upward adjustment of 93,000 jobs in March and April. Notably, May data also mark the 14th consecutive month in which job growth has exceeded projections (source: Bespoke Investment).

The next chart shows just how extraordinary payroll growth has been. Traditionally, the ISM Manufacturing Employment Index and the number of jobs created have shown a close correlation. However, from this perspective, the surge in jobs is striking, with the nonfarm payrolls (depicted as green bars) far outpacing the blue line representing the ISM Manufacturing Employment Index.

Initially, the increase in the US unemployment rate from 3.4% to 3.7% might appear concerning, suggesting negative job growth in the household survey (the payrolls come from the establishment survey). Historical data reveals that there have been only two instances of a simultaneous gain of 300,000 jobs and a month-on-month increase in the unemployment rate of at least 0.3%: July 1984 and May 2023. Nevertheless, when adjusting the household survey data to align with the establishment survey, the number of payrolls would have risen by an even more remarkable 394,000 jobs.

The ADP employment change report for May also presented a healthy picture, with the addition of 278,000 jobs, surpassing expectations by 108,000. As a result, job growth has accelerated for two consecutive months.

Furthermore, initial jobless claims are coming in lower than expected. Although there was a brief increase in the 4-week average claims, the trend subsequently reversed in the last two weeks.

After experiencing a significant decline in recent months, job openings have surged above ten million again.

According to the Atlanta wage growth tracker, US wages continue to rise at an impressive pace. While the expected inflation decline may moderate wage growth rate in the coming months, it will do so from an already elevated level.

The Bad

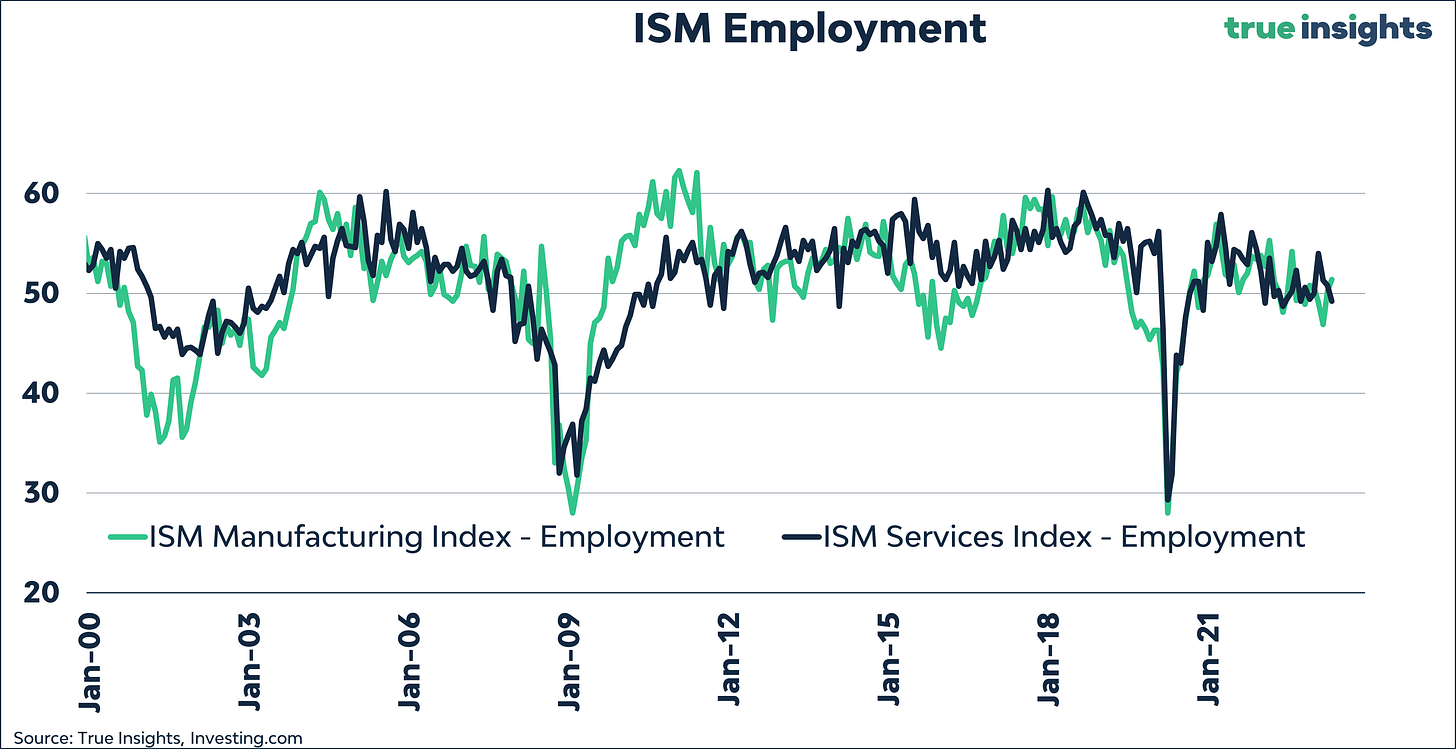

In May, the ISM Services Employment Index experienced its first dip below 50 this year, erasing the modest recovery seen in the early months of 2023.

The number of permanent job losers is rising. The following chart reveals that a decisive positive shift in the year-on-year change of permanent job losers has historically preceded US recessions.

The ‘Quits Rate,’ a measure of the percentage of employed individuals opting to leave their positions, shows signs of slowing, suggesting a substantial decrease in wage growth.

The Ugly

Average weekly hours, generally viewed as an early sign of wider labor market developments, have been on a downward trend, reaching a low of 34.3 hours—the lowest since April 2020.

The year-on-year change in continuing jobless claims has ticked up considerably. Contrary to the year-on-year change in permanent job losers, growth in continuing claims is up to levels seen during previous recessions.

Historical data indicate that the real strain on the US labor market typically begins after the Fed has completed tightening. The chart below depicts the cumulative rise in the unemployment rate 24 months following the end of the Fed’s hiking cycle. Unemployment spiked following every major tightening cycle.

Conclusion

Given the recent US labor market data and a weaker-than-anticipated ISM Services Index (50.3 in May), we believe that the Federal Reserve will have enough room to skip the next rate hike. Our forecast aligns with market expectations, indicating a 26% chance of a June rate hike.