The US is losing its status as 'Supreme Sovereign,' and Moody's affirms this

Aside from the geopolitical and economic impact of the unsustainable debt trajectory of the US, the loss of creditworthiness will have a major impact on your investment portfolio.

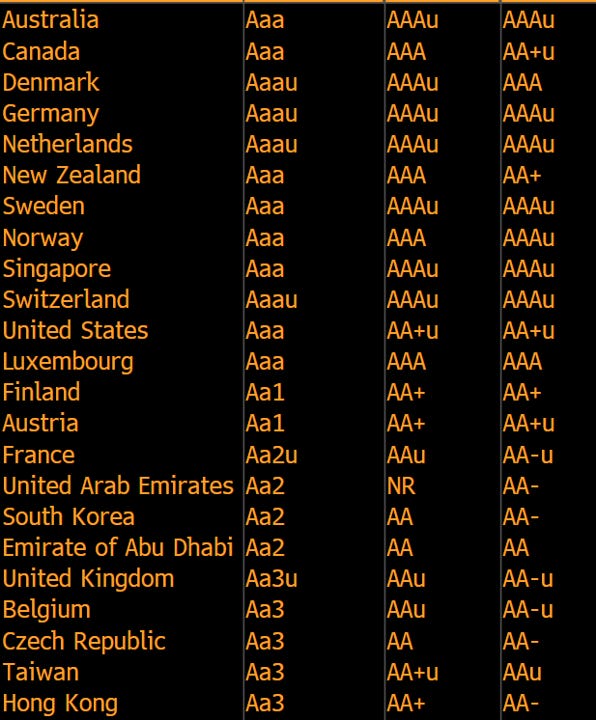

Moody’s changed the outlook on the US government debt to negative but affirmed the US AAA rating. Reading Moody’s rationale, it’s pretty absurd that an AAA rating is the outcome. But at the same time, not unexpected in a transition where the world’s largest and most powerful economy, carrying the deepest and most liquid bond market, gets dethroned. Given current developments, it would be naive not to consider the possibility that the United States may lose its unique, and perhaps untouchable, status in the global economy and financial markets.

Overruled!

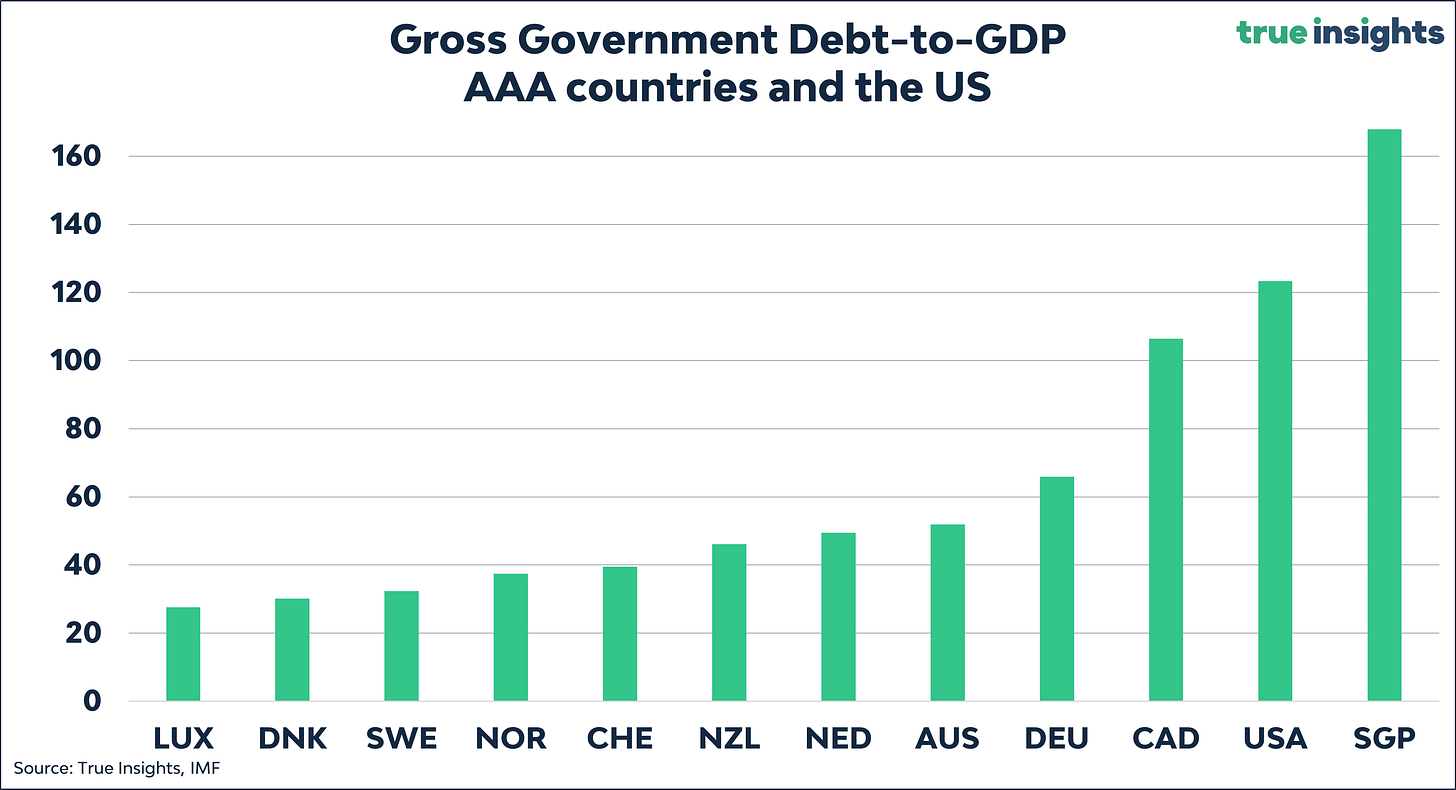

By the way, it must be downright frustrating for Moody’s employees to arrive at a very accurate conclusion, as presented in the second paragraph of Moody’s statement below, only to be overruled and forced to award a Triple-A rating.

AAA how?

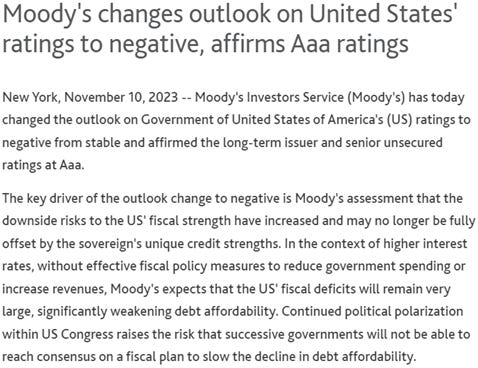

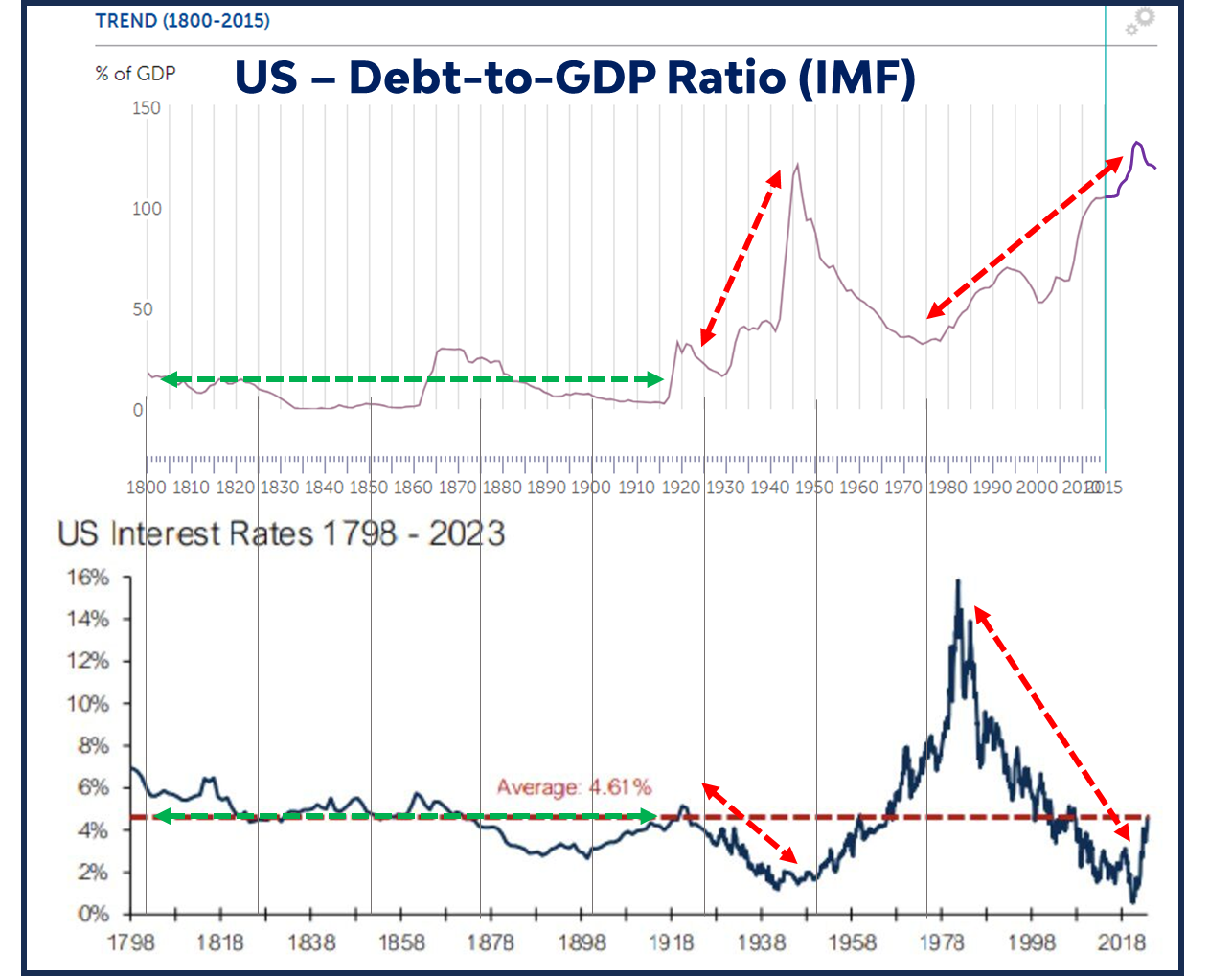

The US Government has no claim on the highest credit rating based on hard data whatsoever. The chart below shows the gross debt-to-GDP ratios of the small universe of countries with a Triple-A rating and the US. Only Singapore has a higher gross debt-to-GDP ratio, but I will come back to that in a second. Except for Canada (16% higher) and Germany (87% higher), the US has a debt-to-GDP ratio over twice as high as the other AAA-rated countries.

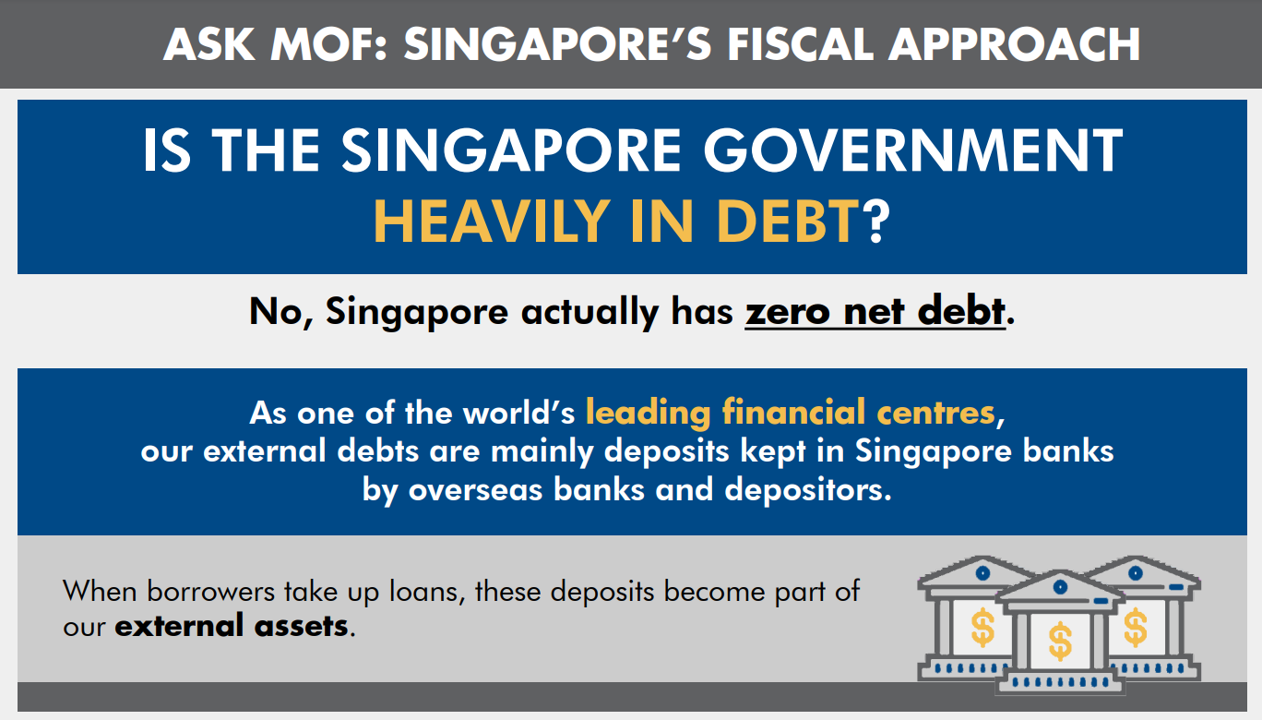

Singapore is an outlier. As one of Asia’s largest financial hubs, its ‘debt’ mainly consists of deposits kept in Singapore banks by overseas banks and depositors. Something the Ministry of Finance is very proud of, as evidenced by the poster on their website below.

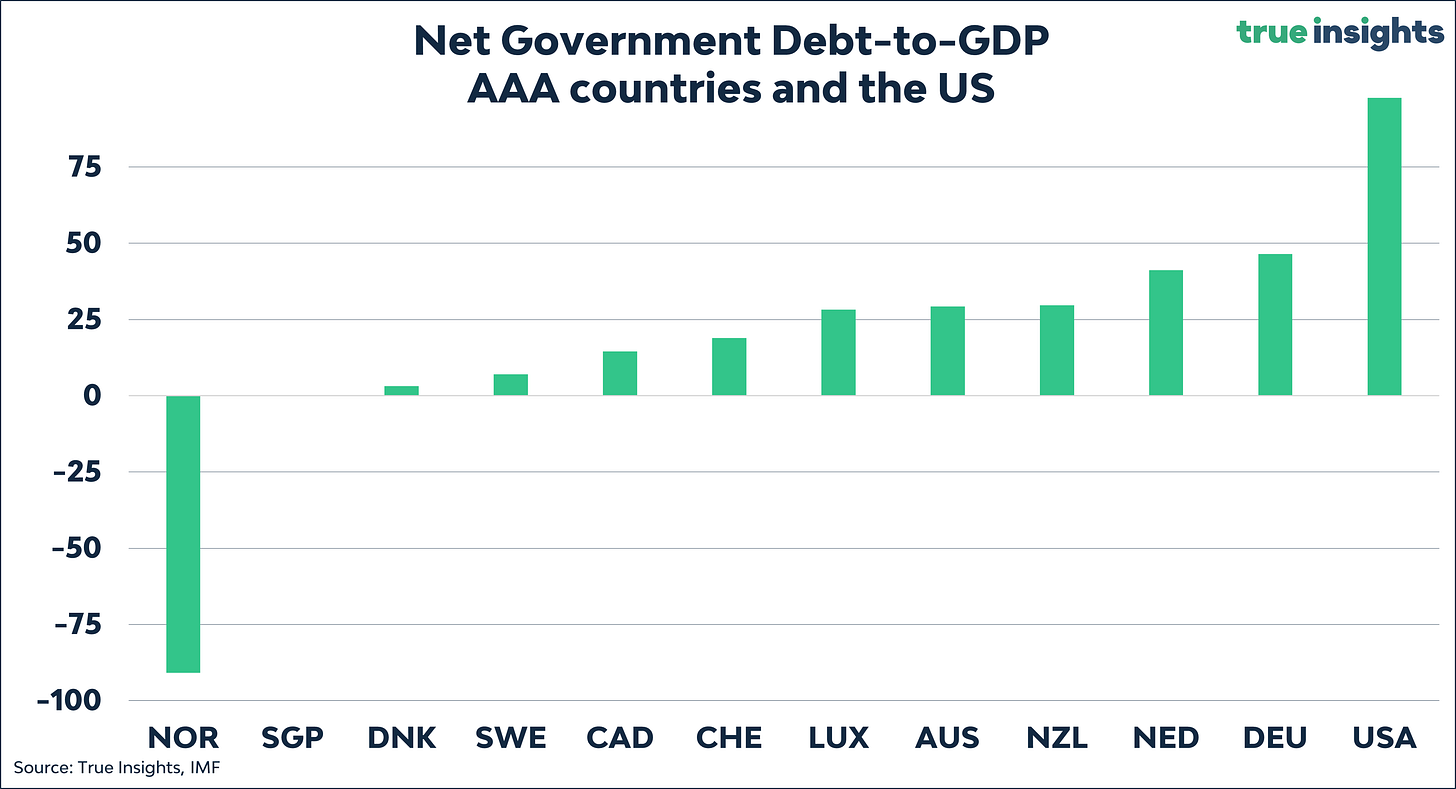

When we consider the financial assets of countries with a Triple-A rating and the US, the net debt-to-GDP ratios look like this:

The US has a net debt burden twice as large as any country with a Triple-A rating. Norway is the only country with assets larger than its national debt. Much larger, to be precise. Primarily due to the Norwegian state pension fund, the Government Pension Fund Global, Norway’s net debt-to-GDP ratio is a whopping -90%.

The chart also reveals that countries without big pockets of financial assets, like the Netherlands and Germany, have understood the importance of keeping their national debt manageable.

Throwing trillions away

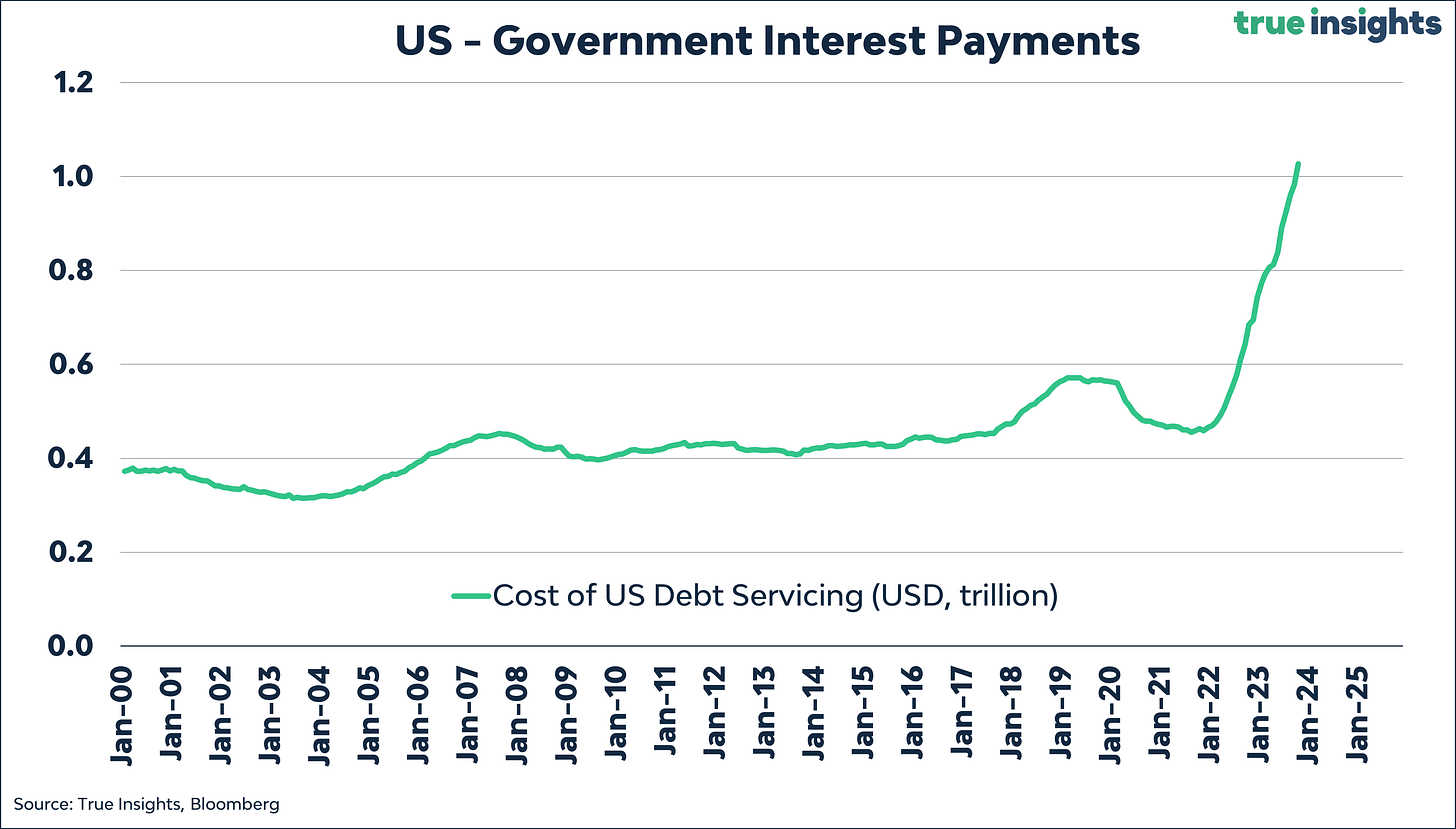

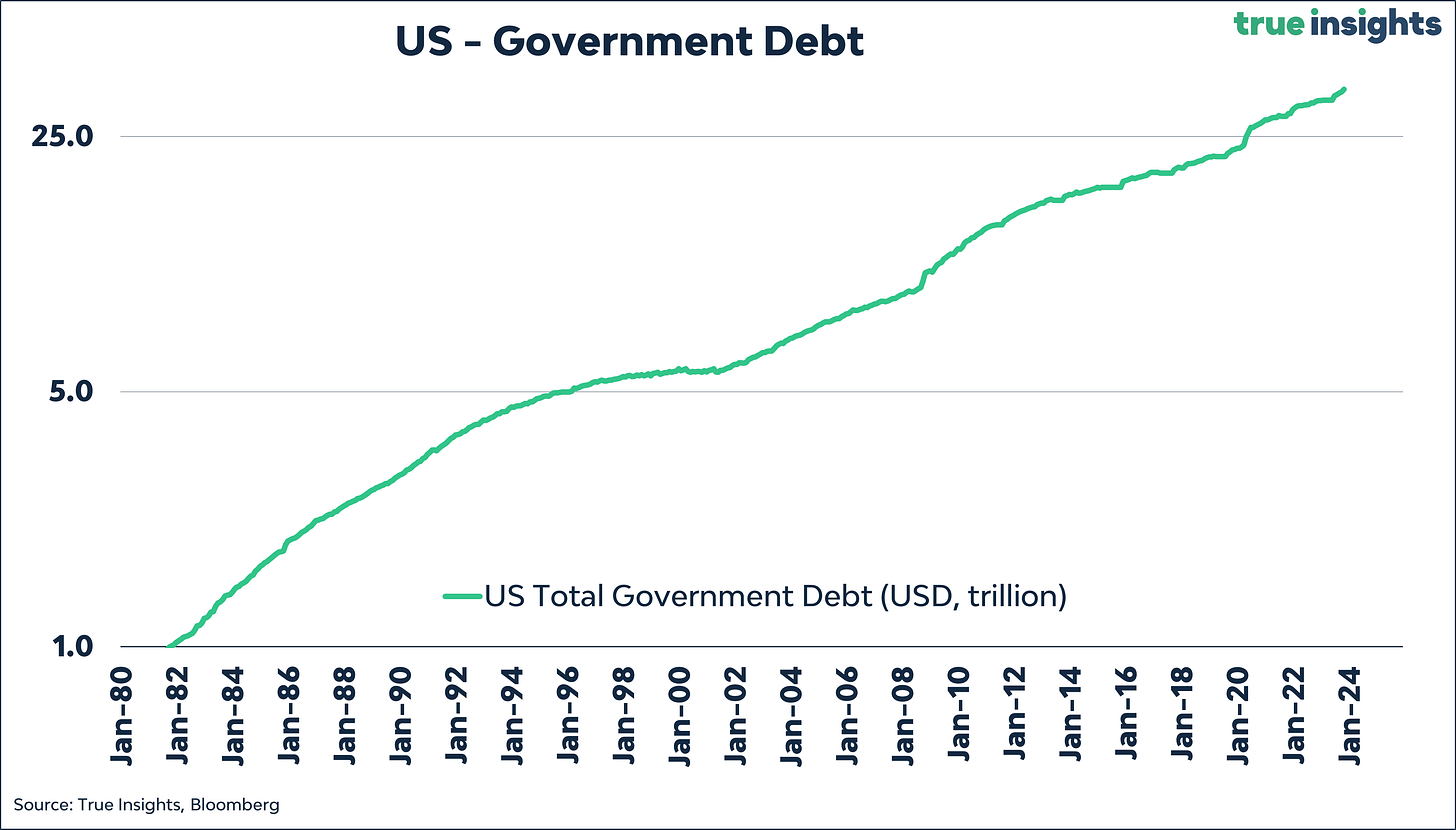

The US has crossed the dubious threshold of USD 1 trillion in (annualized) interest payments. Obviously, the numbers in the chart below should be adjusted for inflation, and a logarithmic scale would look neater, but the picture is clear. The US is on an unsustainable path regarding debt and interest expenses.

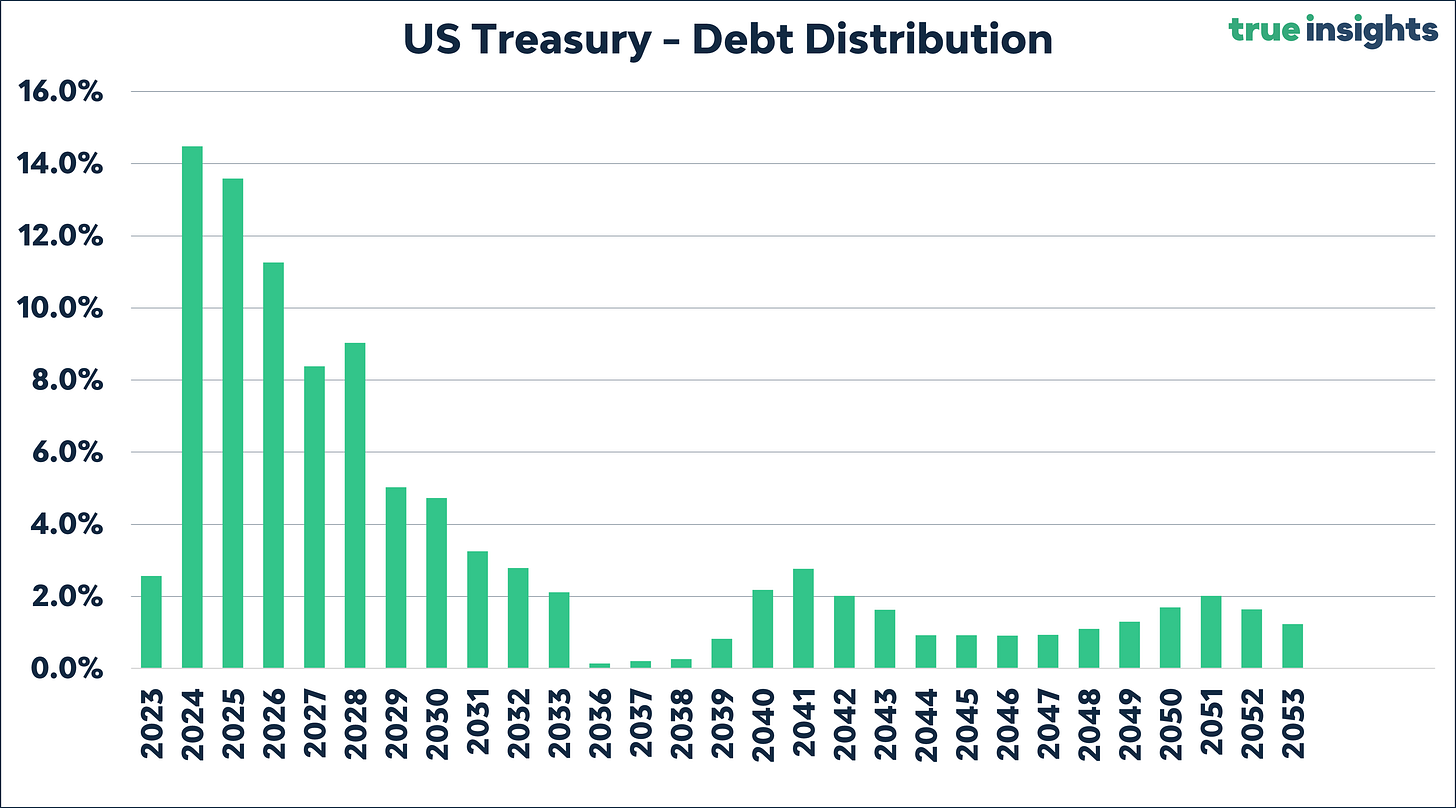

And things are getting worse. With the remainder of 2023 included, the US has to refinance 42% of its national debt over the next three years. That means that every month Powell manages to keep interest rates high, the interest bill will keep climbing. For comparison, Germany and the Netherlands have to refinance 17% and 23% of their national debt over the next three years, respectively.

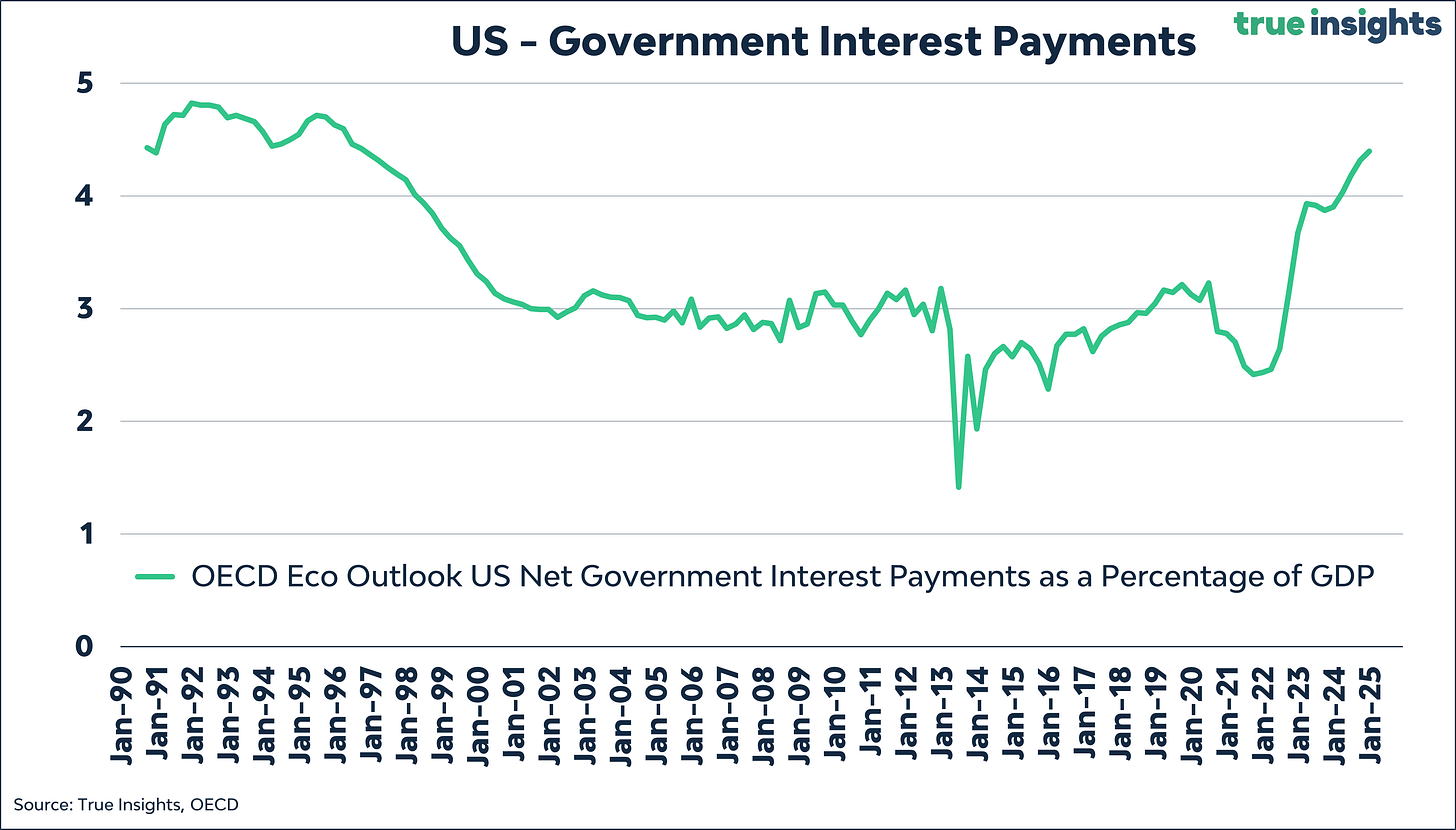

The result of spiking debt levels, skyrocketing bond yields, and a steep maturity wall is that the US will spend nearly 4% of its GDP on interest expenses in 2023. And that number is likely too low, as the OECD estimate is from before the latest spike in interest rates. It is very plausible that the US will have to pay more than 5% of GDP in interest expenses in the coming years. This number excludes the primary budget deficit. In contrast, Germany’s interest payments are a meager 0.6% (!) of GDP. Even Italy, with an even higher debt-to-GDP ratio than the US, pays less in interest expenses. And Italy has a credit rating of BBB, right on the border of creditworthy and ‘JUNK.’

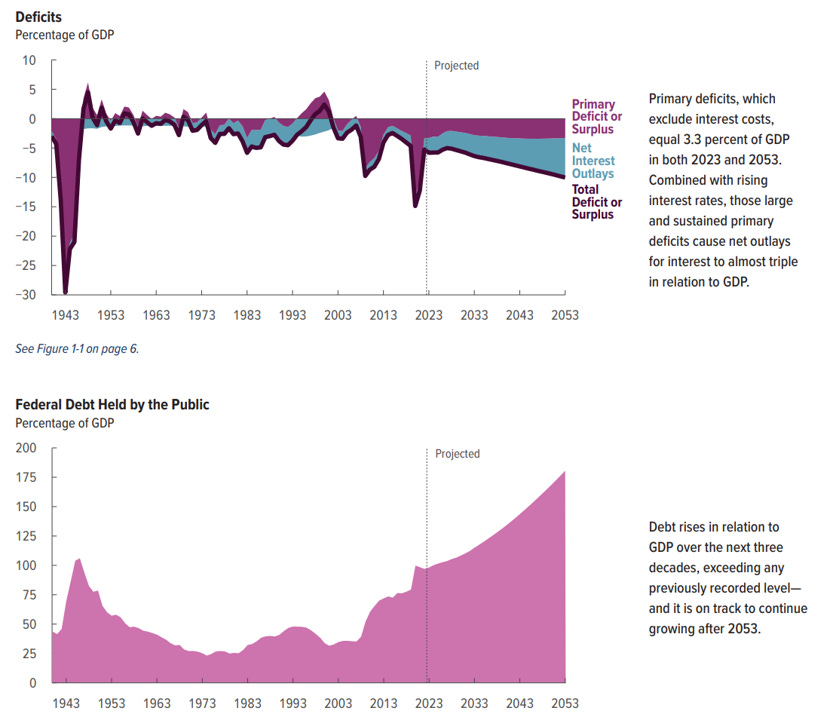

Finally, the US’s primary deficits do not look great either. Below is the familiar chart from the Congressional Budget Office showing that the US is heading towards annual budget deficits of more than 10% of GDP annually. That certainly qualifies for a Triple-A confirmation.

Polarization

As indicated above, Moody’s analysis is pretty spot on. Also because it raises the important issue of ‘continuous political polarization.’ The debt problem has grown so large that only prolonged austerity (or raising taxes massively) will bring down the debt-to-GDP ratio. Especially since aging (shrinking labor force) and steadily declining labor productivity will not lead to structurally faster growth. Rather the opposite.

Achieving such a wave of necessary austerity requires disciplined governments willing to make long-term unpopular decisions and actively take wealth away from businesses and consumers. But politics is moving in the opposite direction. Populism is on the rise, and often, opposition parties take over just a few years after elections and dismantle the policies laid out before. Moreover, very few politicians like to use the word austerity during election campaigns.

Don’t be naive

While an imminent default by the US is not that likely, it is naive to ignore that ever-increasing debts are putting the ‘supremacy’ of the US Treasury at risk. And Moody’s change in outlook is a small but understandable step in this process.

As early as 2011, S&P stripped the US of its Triple-A status, and on August 1 of this year, Fitch did the same. Interestingly, a joint venture with Moody’s Investors Service, China Chengxin International Credit Rating Co, downgraded the United States’ sovereign credit rating from AAA to AA+ already on May 25, 2023.

Since Fitch’s downgrade in early August – which meant the US officially lost its Triple-A status, as two of the three major credit rating agencies no longer awarded the highest credit rating – US Treasury debt has increased by a mind-boggling USD 1.1 trillion, a 3.4% increase in just 3.5 months. It’s only a matter of time before Moody’s removes the US from Triple-A.

Adjust your portfolio!

In addition to the possible geopolitical and economic impact of lower US credit ratings, the ever-growing debt pile will have significant consequences for investment portfolios.

Volatile Interest Rates

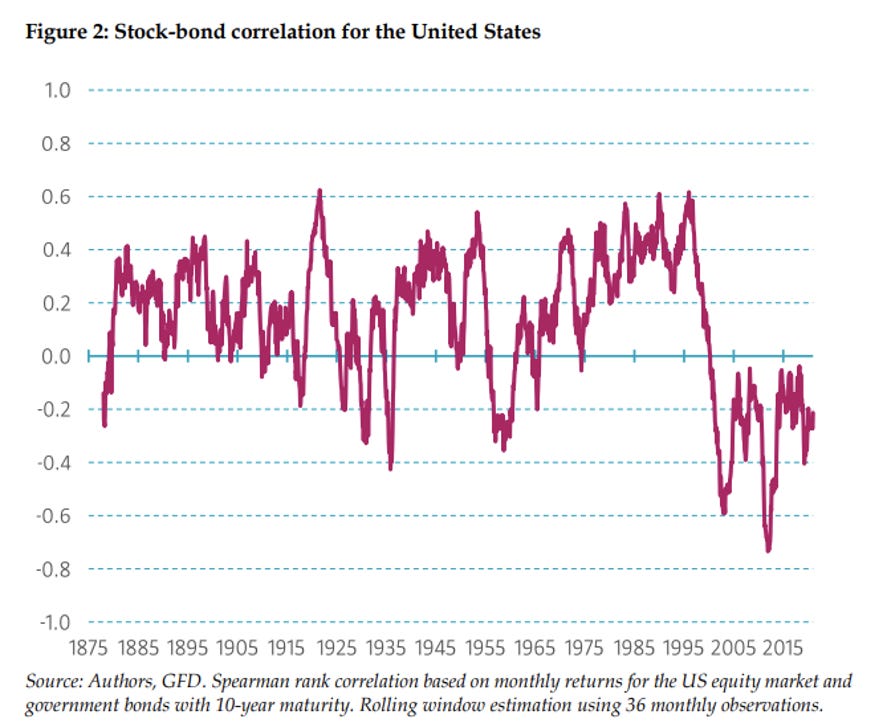

Lower creditworthiness generally means higher interest rate volatility. From a risk perspective, government bonds become less attractive, for example, within a traditional 60-40 portfolio.

Positive Correlation

When default risk rises, correlation with ‘other’ risky investments like stocks will increase. This goes against the common belief that the correlation between stocks and bonds is negative. However, a recent chart from my former colleagues at Robeco shows that historically, one should expect a positive correlation, not a negative one. From this angle, bonds also become less appealing.

Yield Curve Control

I expect that higher interest rates due to declining creditworthiness will not materialize. In a debt-driven economy, this effectively means giving up GDP growth entirely. This is not politically or socially feasible. Yield Curve Control, potentially implemented through Quantitative Easing, is likely to get more widely implemented. Japan and Italy, which benefits greatly from the ECB’s policy (almost all ECB PEPP reinvestments go to Italy), are examples of this. (Chart Robin Brooks, IIF)

Negative Real Yields

In addition to structurally low interest rates, in the absence of support for austerity, inflation is also a way to try to keep the debt pile manageable. Adjusting central bank inflation targets, for example, from 2% to 3%, is not unthinkable. In that case, interest rates are likely to become structurally negative.

More volatile and structurally lower interest rates on US Treasuries are far from unthinkable. This makes bonds less attractive in a multi-asset portfolio. This is the key reason the weight of government bonds in our multi-asset portfolios is considerably lower than based on total market capitalization. By the way, stocks are not entirely off the hook either. The support for significantly higher corporate taxes is much higher than for personal taxes.

Real or scarce assets will become more attractive in a low, volatile interest rate and higher inflation environment. Investors would do well to allocate at least a portion of their portfolio to Gold, Bitcoin, and Commodities. For the first two, they represent an insurance premium outside the traditional system, for example, against the waning status of the US as the ultimate haven bond market. Moody’s action again underscores that you don’t need extreme views to adjust your portfolio to the changes happening in financial markets. To quote Stephen Hawking, ‘Intelligence is the ability to adapt to change.’