Ugly CPI report leaves Powell less room to sound dovish

The latest CPI report, revealing a nearly 7% inflation rate of Core Services ex Housing, will complicate Powell's mission to realize a soft landing. This brings risks to both equities and bonds.

Here are my key takeaways from the latest US CPI report.

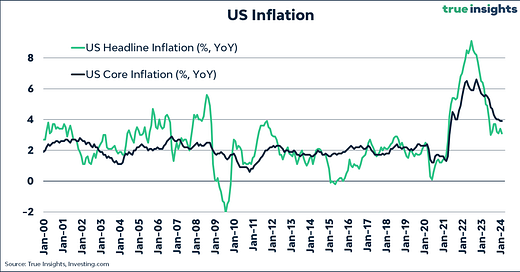

Headline inflation fell to 3.1%. Although this was lower than the previous month (3.4%), inflation exceeded expectations of 2.9%.

Core inflation rose by 0.4% month-on-month, the strongest increase since last May. As a result, core inflation remained at 3.9%, not decreasing as expected.

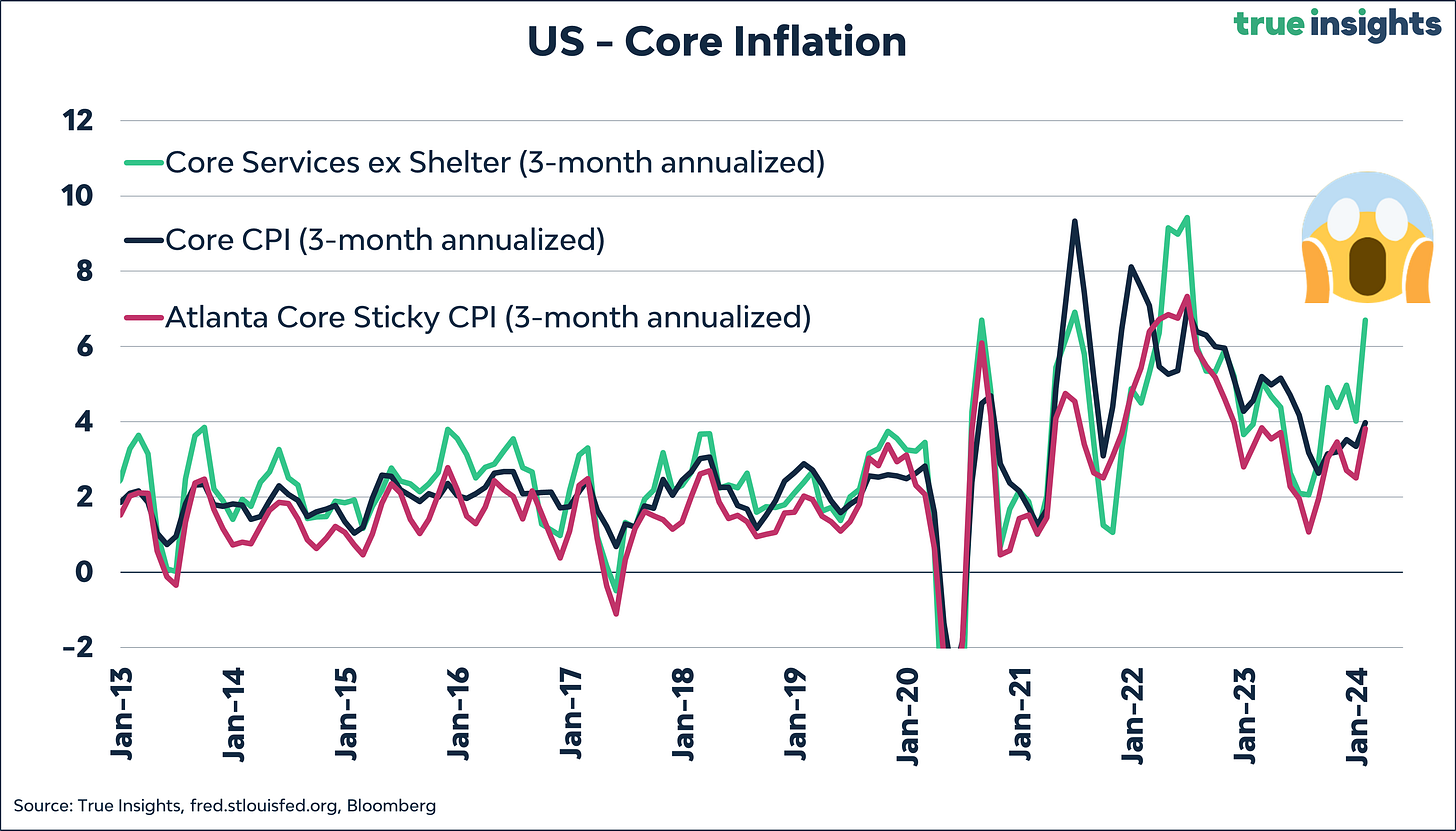

The real shocker, however, came from the Core Services excluding Housing CPI. The three-month annualized inflation rate, a calculation method long favored by Powell for this inflation measure, reached 6.7% in January. It’s the fourth-highest figure of this series since the inflation crisis began in late 2021.

Other Core CPI measures also increased.

As befits a central banker, Powell will have this chart on his refrigerator:

In short, this was an unfavorable inflation report, forcing Powell & Co. to deviate from their focus on achieving a ‘soft landing.’ As the latest FOMC press conferences revealed, Powell is eager to step out of the shadow of his predecessors who failed to avoid a recession after a major tightening cycle, hoping to secure a third term as Fed Chairman. It’s no secret that Donald Trump is not a fan of Powell.

Will the dove fly?

Powell has little left to sound dovish.

Nonfarm payrolls grew by more than 300K in the last two months, indicating a booming economy.

The underlying ISM price indices surged in January.

The Atlanta Fed GDP growth tracker indicates 3.4% GDP growth in Q1.

On the other hand:

Inflation expectations remain anchored. However, short-term expectations are moving upwards.

The Fed primarily looks at PCE data instead of CPI data. In December, the 3-month annualized Core Services ex Housing inflation rate stood at a moderate 2.1%, half of the same figure from the CPI report. However, if the PCE index shows the same increase in January as the CPI figure, the inflation rate will spike to 4.9%.

In recent years, we’ve observed a relatively high number of items experiencing a month-over-month increase of more than 1% in January.

Conclusion

Markets are now pricing in just 3.7 rate cuts for this year, with the first rate cut not expected until June.

This is a setback for both stocks and bonds.

Investors must consider which asset class is more impacted regarding risk and return.

Take into account that an increasing number of macro indicators suggest that the ‘recession’ is already over and the earnings outlook is improving.

Although we have one more CPI report before the next FOMC meeting, the chance of a (temporary) correction in risky assets has increased.