Well, this is pretty big - Introducing the Blokland Smart Multi-Asset Fund

I have taken a massive leap as an investor and launched a multi-asset investment fund that invests in three scarce asset classes.

I've taken a bold step and established a brand new investment fund: The Blokland Smart Multi-Asset Fund, registered with the Dutch Authority for the Financial Markets (AFM). This is a huge milestone that I'm incredibly proud of, and it will allow me to assist even more investors in managing their investment portfolios. Rest assured, this doesn't mean I'll stop writing research stories. On the contrary, I’m looking into some tangible possibilities to increase both the scale and scope of the research. Should you have any questions after reading this article, please feel free to send a message.

The Blokland Smart Multi-Asset Fund

The Blokland Smart Multi-Asset Fund allows investors to capitalize on major, structural changes in financial markets by investing in a smart combination of scarce assets from traditional (quality stocks) and alternative (physical gold and bitcoin) markets. And I'm not just the founder but also the fund's proud first participant. Hence, we will go on this journey together for those who decide to invest in the fund!

In this article, I detail the fund's philosophy, its underlying investments, 'The Emergency Brake,' which significantly limits losses during market downturns, and other key risk-return features. In addition, for those interested, a series of contributions and a presentation will provide a deeper insight into the fund's main characteristics.

Investing in scarcity

If I were to distill the philosophy of my investment fund into a single word, it would undoubtedly be 'Scarcity.' In a world increasingly burdened by debt, uniquely scarce assets present the most promising investment opportunities. This is why the Blokland Smart Multi-Asset Fund invests in stocks of quality companies, physical gold, and bitcoin.

A world of debt

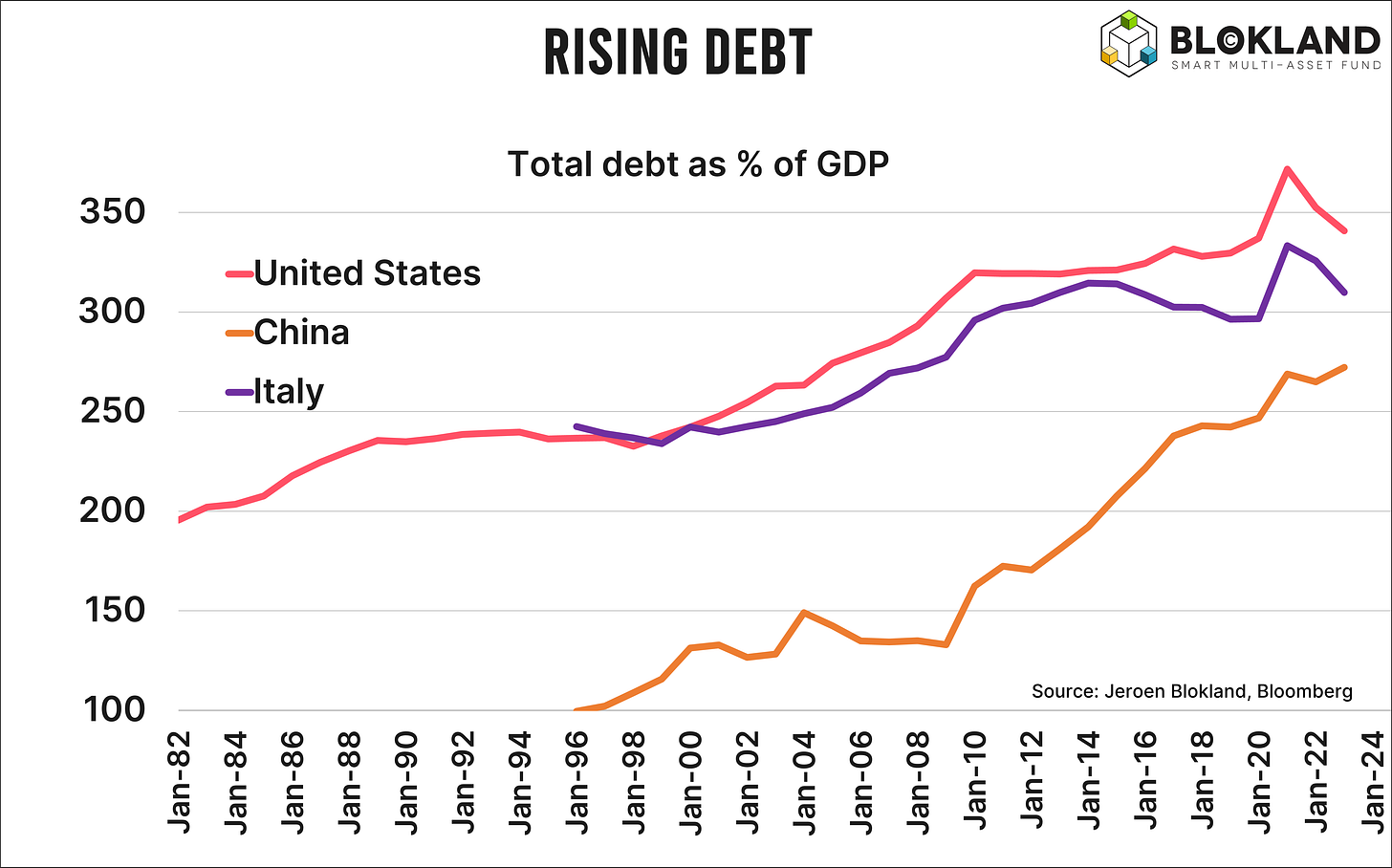

The prevailing economic growth model hinges entirely on debt. We're witnessing rapid aging in the world's largest economies, translating into a shrinking workforce. Despite technological advances, historical trends suggest we should not expect a structural increase in productivity, especially now that more employees prefer to work only four days a week.

Consequently, we're seeing an escalating reliance on debt to fuel economic growth. This trend has propelled global debt and, hence, the volume of outstanding bonds to unprecedented heights. Each economic and financial crisis sees debt levels spiraling higher without ever reverting to their previous levels.

No bonds

Most 'diversified' investment portfolios consist only of stocks and (government) bonds. I know few asset managers who offer anything different. However, this traditional approach is becoming increasingly outdated.

One critical question looms: How will the massive and ever-growing debt pile remain sustainable? Budget cuts seem unlikely in today's politically charged and polarized climate, where public support for structural austerity has waned. Moreover, with an aging population, the prospect of growing out of the debt issue isn't straightforward.

The 'solution' to debt sustainability is found in financial markets. Structurally low interest rates and higher inflation effectively kick the 'debt can' down the road. Because towering debts theoretically require higher interest rates, central banks remain extremely dominant to keep rates down. A further monetary expansion, including turning on the printing presses again, seems just a matter of time. And as we have witnessed in recent years, such moves increase the likelihood of inflation spikes. While higher inflation benefits those issuing debt, it adversely affects debt (bond) investors.

Low interest rates coupled with higher inflation make bonds an unattractive investment. Additionally, as doubts over debt sustainability mount and central banks are forced to work harder to keep markets under control, bonds become riskier. As a result, their traditional role as risk mitigators in investment portfolios diminishes.

Like to invest or have questions? Contact me at jeroen@bloklandfund.com or leave your details at bloklandfund.com. More information can be found there.

The alternatives: gold and bitcoin

The current monetary system and 'our' money are based on a combination of debt and trust, a stark contrast to just 50 years ago when it was based on gold. While reverting to a new gold standard is not feasible with the excessive amounts of money out there, gold's unique scarcity and thousands of years of history as money and a 'store of value' make it a cornerstone for a superior composition of an investment portfolio in a debt-dominated world.

Other scarce assets like art, wine, antiques, and classic cars also represent attractive investment alternatives. However, their acquisition and upkeep are often more demanding and costly than gold. Nonetheless, it pays to diversify within scarce assets as well. Bitcoin is rapidly evolving into a mature financial asset class functioning as digital gold. A truly scarce 'currency,' competing with the oversupply of dollars and euros. A promising, yet risky investment that is swiftly being embraced by investors worldwide and does not depend on trust.

Quality Stocks: A traditional scarce investment

Attractive scarce investments are found in traditional markets, too. Quality companies have strong business models and sustainable competitive advantages. They carry little debt and realize relatively stable earnings that are less vulnerable to economic fluctuations. In addition, quality companies have proven to profit from changes. As a result, shares of quality companies achieve a better return than the overall market and with less risk.

Strong loss limitation with 'The Emergency Brake'

To drastically reduce losses during significant stock market downturns, the Blokland Smart Multi-Asset Fund employs 'The Emergency Brake.' 'The Emergency Brake is a smart proprietary sentiment indicator that determines if the fund should temporarily exit stocks or bitcoin during unfavorable market conditions.

To illustrate the power of The Emergency Brake: amidst the 'Dot Com' Bubble burst from 2000 to 2003, where global stocks plunged by 58%, the combination of quality stocks and The Emergency Brake would have contained the drawdown to just 20%. During the Great Financial Crisis, stocks fell by 60%, but the combination of quality stocks and The Emergency Brake capped the loss at 'only' 16%. Equally important, The Emergency Brake features recovering losses faster and reaching a new performance peak sooner.

Like to invest or have questions? Contact me at jeroen@bloklandfund.com or leave your details at bloklandfund.com. More information can be found there.

Investing is about return AND risk

As clearly demonstrated by The Emergency Brake, in the Blokland Smart Multi-Asset Fund, mitigating risk is at least as important as achieving high returns. The mix of quality stocks, physical gold, and bitcoin is strategically designed to parallel the risk profile of a traditional portfolio, typically comprising 60% stocks and 40% bonds.

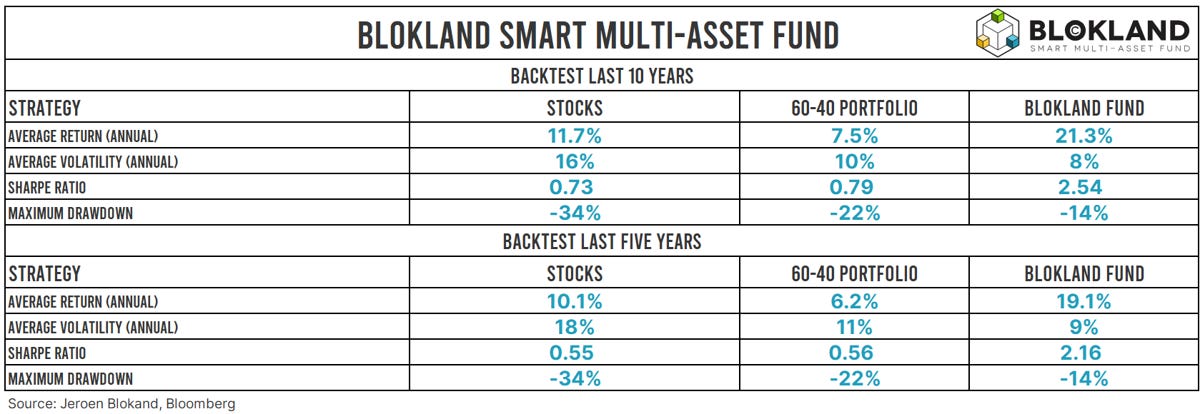

Yet, historical data suggests that the Blokland Smart Multi-Asset Fund would have significantly outperformed such a conventional 60-40 portfolio. The fund's annual return (before costs) would have been around 20% in the past five and ten years. While past performance does not indicate future results, the fund aims to realize higher returns than stocks, but with roughly half the risk.

Risk-Return characteristics

We have conducted a backtest over the last five and ten years. A longer period is not feasible since Bitcoin has not existed for much longer. Obviously, we have longer back tests available for the combination of quality stocks and gold.

In the table below, I compare the returns, volatilities, and Sharpe Ratios of an investment in equities (MSCI World Index), the traditional 60-40 portfolio (60% stocks and 40% bonds), and the backtest of the Blokland Smart Multi-Asset Fund (excluding costs).

The key results:

The Blokland Smart Multi-Asset Fund would have performed considerably better than both stocks and the 60-40 portfolio, with an estimated return of 21% and 19% over the two backtest periods.

The volatility would have been significantly lower than that of stocks but also lower than the 60-40 portfolio. This is the result of The Emergency Brake and the goal of a volatility near that of the 60-40 portfolio, as the fund 'replaces' the 40% bond component.

As a result of the above, the Sharpe Ratio is significantly higher.

Finally, the effect of The Emergency Brake is clearly visible through the maximum drawdown, which is considerably lower than the 60-40 portfolio and much lower than that of stocks.

To be clear, past results in no way guarantee future performance. This is especially true given the relatively short backtest period. That does not mean I lack confidence that the fund will perform much better than the traditional 60-40 portfolio and even better than stocks. But, of course, the 'proof of the pudding is in the eating.'

A slight nuance

What does this mean for True Insights? Not much! Well, except for a potential expansion of the research offering, which I’m looking into as we speak. I will continue to write actionable research about financial markets and various asset classes.

Again, thank you for your ongoing support. I look forward to your questions and reactions. If you want to know more about the Blokland Smart Multi-Asset Fund or are interested in investing, please don't hesitate to contact me (jsblokland@true-insights.net or jeroen@bloklandfund.com).

Warm regards,

Jeroen