The Weekly Market Monitor (31) – Bye, Bye, Triple-A

The US has lost the Triple A-rating, which, unlike many suggest, will have major implications. If not in the short run, then definitely in the long run.

Welcome to the Weekly Market Monitor, keeping you updated on the week’s most important charts and developments in financial markets. This week we thoroughly discuss the US losing its Triple-A rating after the Fitch downgrade and the implications for financial markets. We take an in-depth look at the latest Federal Reserve Loan Survey, which points to negative US GDP growth, a quintupling of defaults, and a major spike in high yield bond spreads. And with the ISM Manufacturing stuck at 46.4, Macro doesn’t look great for equities either. We also highlight the latest rate hike by the Bank of England and spend nine charts on the current earnings season. Finally, we update our Fear & Frenzy Sentiment Index and show the divergence in Bitcoin and NASDAQ volatility, underscoring that they are very different asset classes. Enjoy the Weekly Market Monitor!

Stories

MACRO

Bye, bye Triple-A

For some, it came as a total surprise. For others, it was inevitable. The US has lost its Triple-A status after a downgrade by Fitch. And as S&P Global already downgraded the US rating in 2011(!), only Moody’s maintains the highest possible credit rating among the three major rating agencies.

Given the opposing views among investors regarding the ‘appropriate’ rating for the US – and many other heavily indebted countries – it is not surprising that the Fitch downgrade sparked a major discussion.

To us, the US downgrade should not be seen as a major upset. Assuming rating agencies do, in fact, take into account the size and trajectory of debt-to-GDP ratios, it is justifiable for Fitch to lower the rating of the US. Especially considering the sharp rise in interest rates.

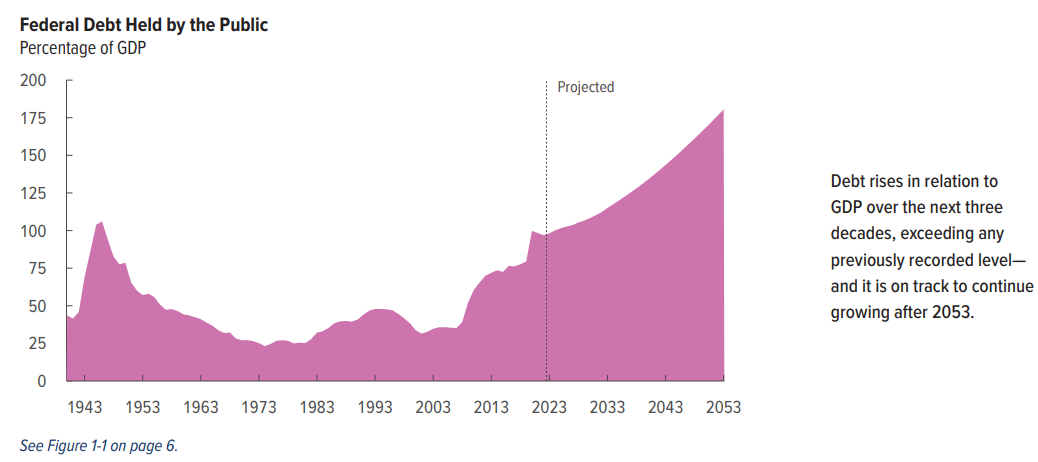

According to the latest estimates from the Congressional Budget Office, the US debt-to-GDP ratio is projected to increase from about 100% to 181% by 2053.

Over that time, the budget deficit is set to rise from about 6% to over 10% in 2053. These figures are ‘challenging,’ to say the least. Additionally, if interest rates exceed those in the CBO’s base scenario, the US debt-to-GDP ratio could soar to 230%. Good luck with that!

What are the consequences?

While the US Treasury market is unlikely to lose its ‘safe-haven’ status any time soon, mainly because it remains the largest and most liquid bond market on our planet, it would be unwise to dismiss the downgrade as irrelevant, as some prominent figures have done in recent days. Since the downgrade, long-term interest rates in the US have increased, both from an absolute level and relative to the other ‘haven’ asset across the Atlantic, German government bonds.

Moreover, the downgrade again highlights the much bigger underlying issue, the sustainability of the global debt burden. The assumption that faster economic growth and austerity measures are unlikely to reverse the trend in debt-to-GDP ratios is one of the long-term beliefs attached to our investment framework. Higher inflation and low-interest rates will be required to ‘maintain’ debt sustainability. This underscores why we invest in real estate, commodities, inflation-linked bonds, gold, and Bitcoin, in addition to traditional asset classes like stocks and bonds.

Jeroen recently wrote the first part of a two-part series on this topic, and we will send it out as a separate post in the coming days.

SLOOS

Below are the key takeaways of this week’s Insight on the latest Federal Reserve Senior Loan Officer Opinion Survey, or SLOOS.

Negative Loan Growth

Bank lending growth based on the last six months has turned negative, year-on-year numbers are destined to follow.

Slow or Negative GDP Growth

Year-on-year GDP growth would need to drop to -2.5% to align the two lines in the graph below.

Spiking Defaults

Tighter lending standards result, without exception, in an increase in bankruptcies. Based on the historical relationship between lending conditions and high-yield defaults, the latter is expected to rise to around 7.5% this year, nearly quintupling(!) compared to 2022.

Low Spread

High Yield spreads currently reflect ZERO chance of a recession and ZERO chance of default, diverging massively from tighter lending conditions. This is totally out of whack with tighter lending standards.

US ISM Indices – a Mixed Bag

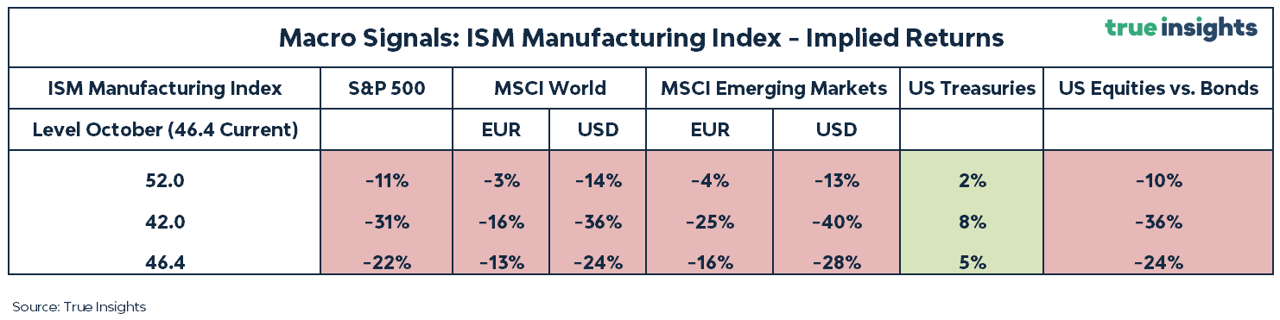

The ISM Manufacturing Index barely rose in July, remaining at a meager 46.4. Although the underlying picture was slightly more favorable, with a positive gap between the New Orders and Inventories indices, the signal for equity markets remains negative.

Below is an update of our ISM-Implied Returns scenario analysis, and it does not bode well for stocks.

In all three scenarios, stocks in all regions face significant downside, while the upside for US Treasuries remains positive but is diminishing. Are markets headed for a repeat of 2022?

Regarding US Treasuries, we do not expect things to get as bad as last year, but the outlook for stocks is questionable. We continue to be underweight in Emerging Market Equities, Global Real Estate, and Global High Yield Bonds, and we will not hesitate to go underweight in Developed Market Equities if investors turn away from central bank and earnings hopium.

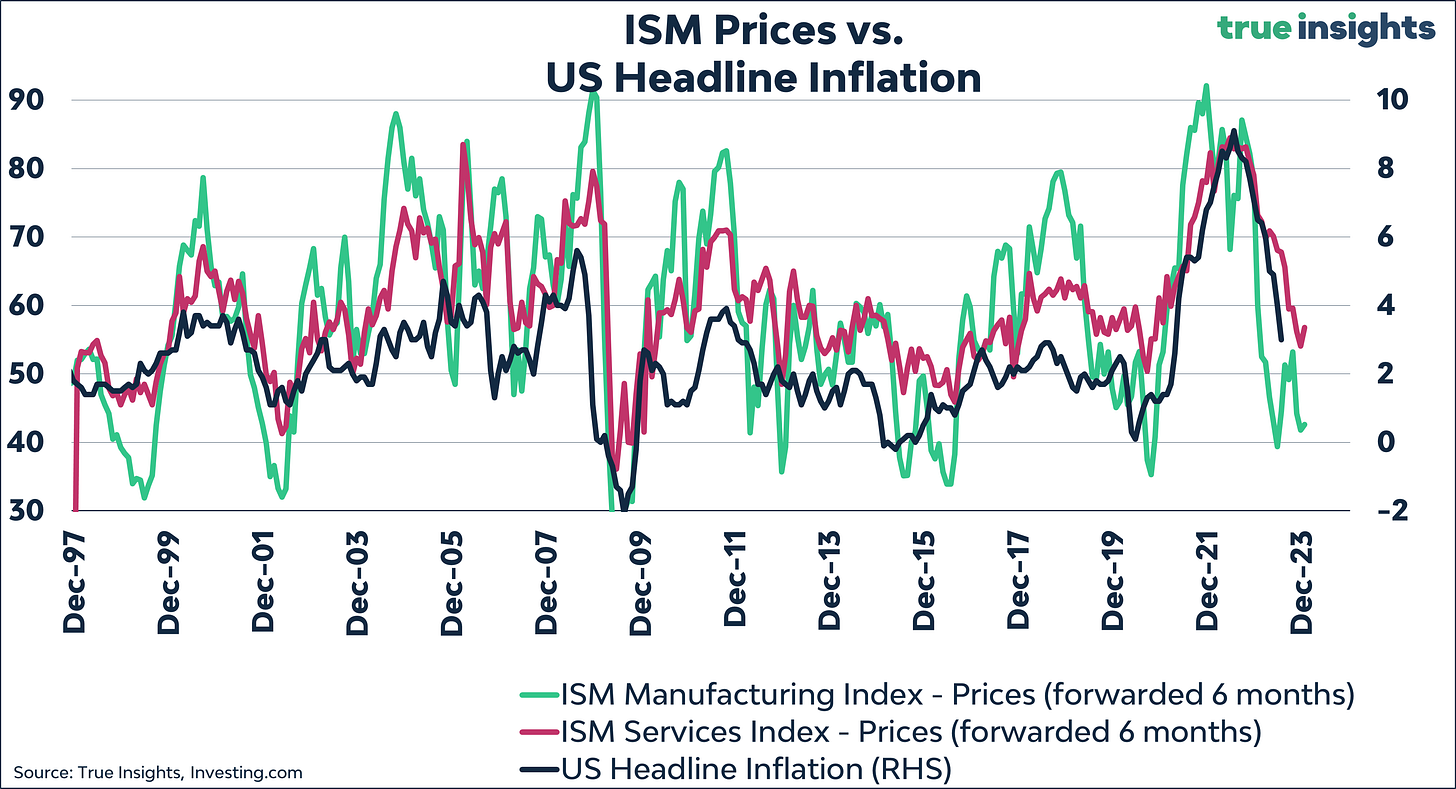

US Services – Ouch, Prices Paid

The latest ISM Services Prices Paid Index proves that Treasuries are not entirely out of the woods either. The Index unexpectedly rose from 54.1 to an elevated 56.8 in July, indicating that price pressures in the service sector remain significant. This may be influenced by seasonal factors, with prices of holiday-related services increasing during summer, but Powell will surely take note of this. However, unit labor costs rose only 1.6% in the second quarter, providing some relief on wages.

Eurozone Price stickiness

The Eurozone also saw a price disappointment. Core inflation remained at 5.5% in July, against a slight decline to 5.4% expected.

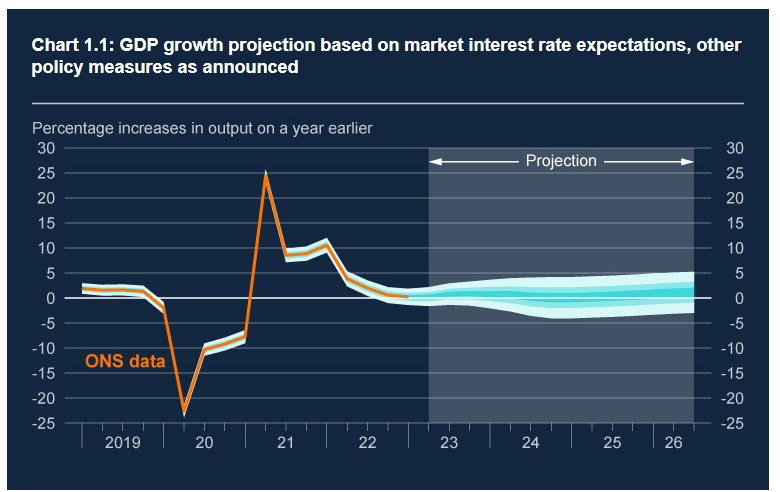

This figure comes when central bankers have balanced their forward guidance regarding future interest rate hikes. The Bank of England, as expected, raised interest rates by a quarter-point, and given headline inflation of nearly 8% and core inflation of over 7%, Governor Bailey could only emphasize the need for more rate hikes if inflation doesn’t come down quickly enough. However, with an expected economic growth of approximately zero in the coming years(!), an effective tool to bring down inflation is already at work.

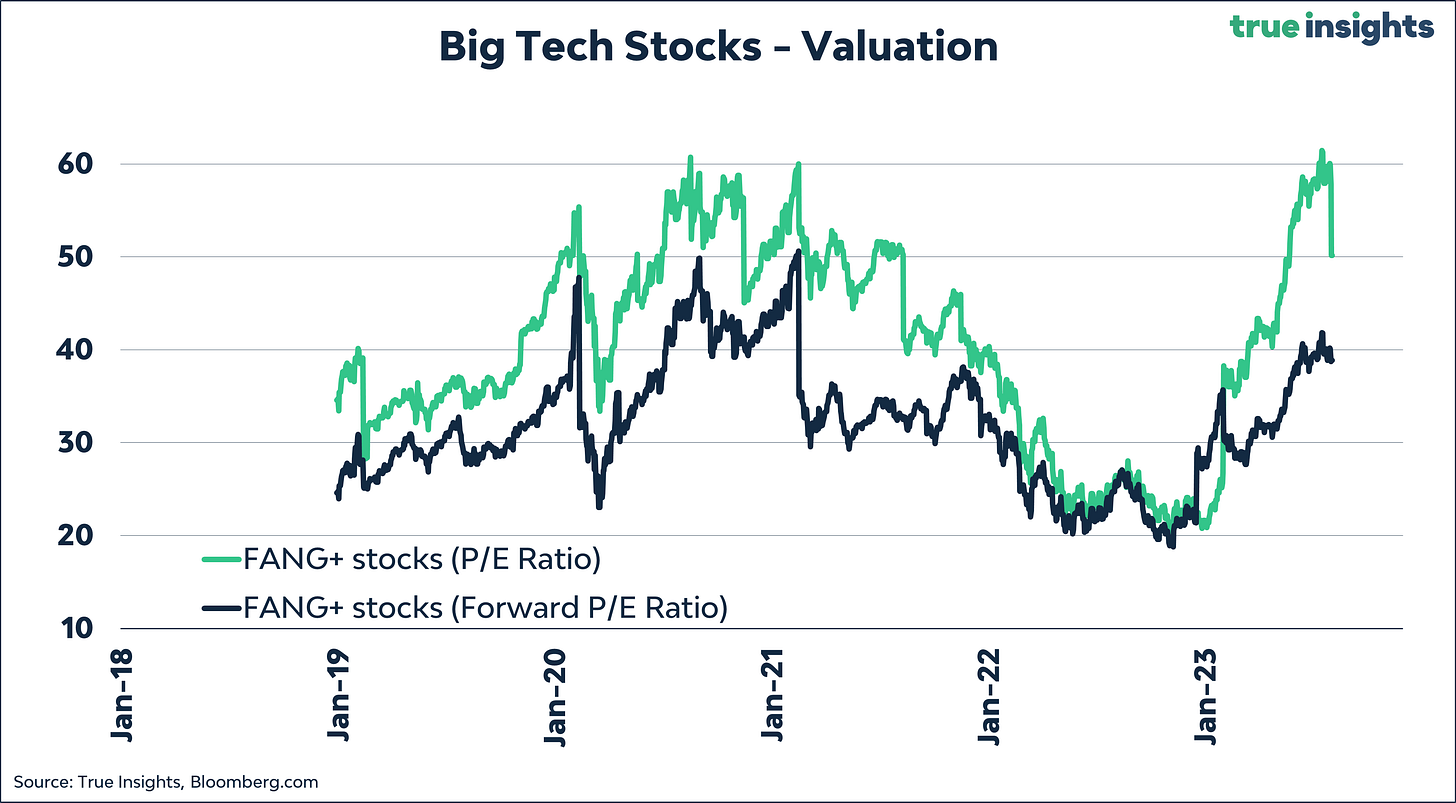

While new inflation disappointments should not be ruled out, with the cautious shift in central bank rhetoric and a significant chance of a recession, the end of the series of rate hikes is approaching. Historically, the period following the end of the Fed tightening cycle has been positive for both Equities and Treasuries. However, given several macro indicators like the ISM Manufacturing Index flashing red and the towering valuation of tech stocks, we find it (much) too early to overweight Equities.

China muddling through

The two Chinese Manufacturing PMIs are below 50, and incoming news, particularly from the real estate sector, is not encouraging. The real estate sector is struggling and can only recover with drastic measures such as interest rate cuts, debt renegotiations, or restructurings.

Valuation

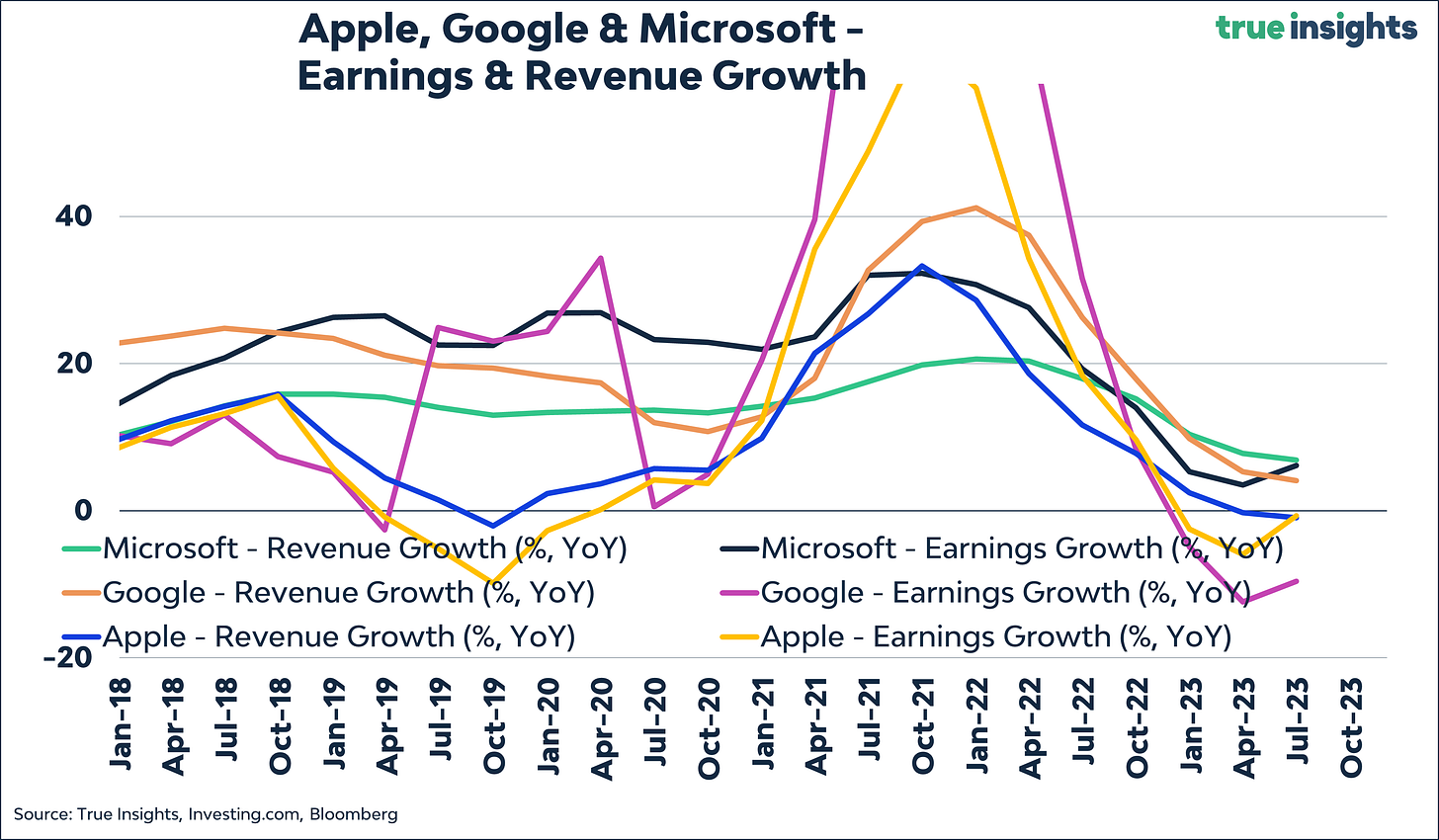

Most Big Tech companies have reported their earnings; on average, they were ‘enough’ to keep the Artificial Intelligence dream alive. However, companies like Microsoft and Apple reveal that the recovery from the quarter-long declining profit and revenue growth is by no means exuberant.

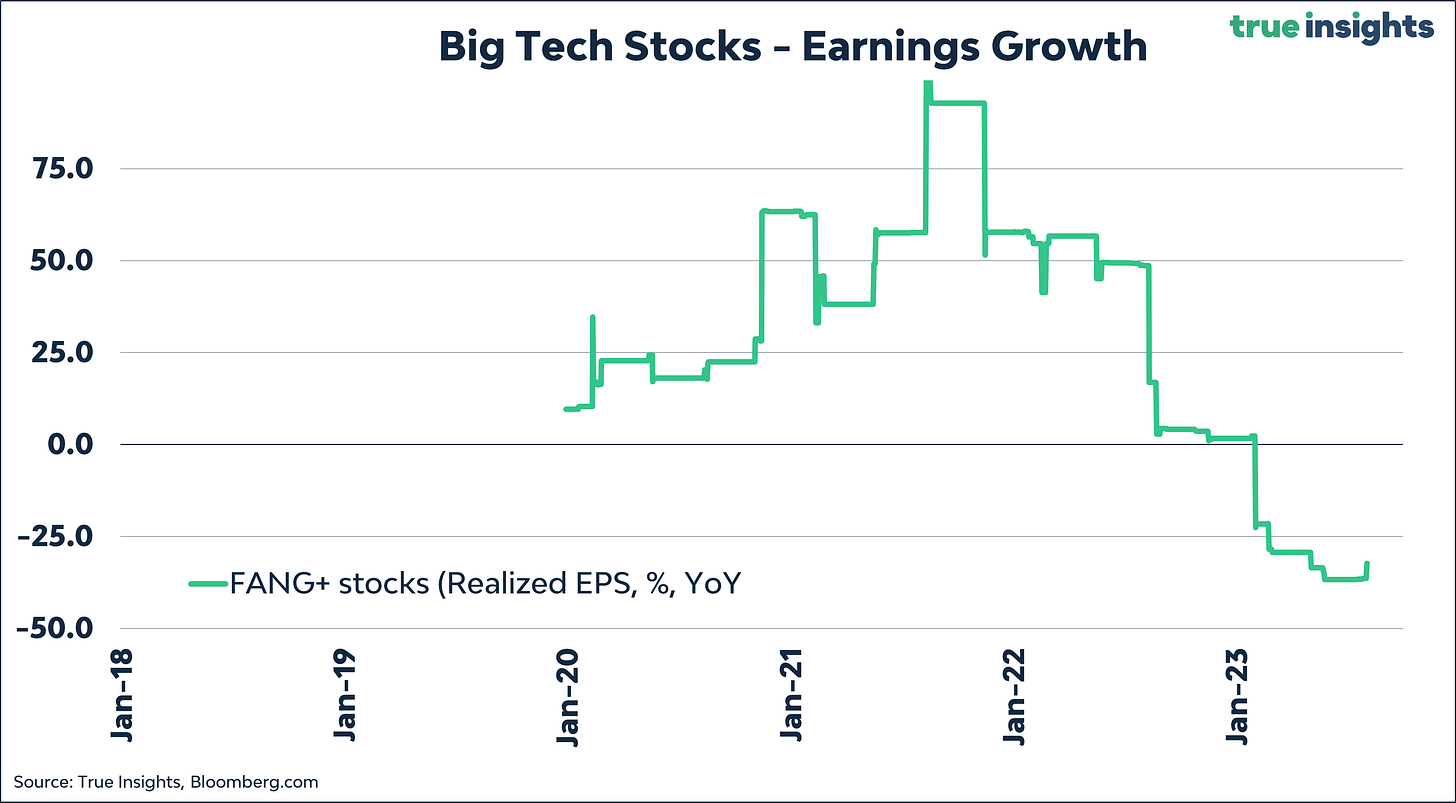

Based on the most recent data, the earnings per share of the NYSE FANG+ Index (Alphabet, Amazon, AMD, Apple, Meta, Microsoft, Netflix, NVIDIA, Snowflake, and Tesla) increased by 6% compared to the previous quarter. However, the earnings per share are still over 30% lower compared to a year ago.

Hence, the valuation of Big Tech companies remains exceptionally high even after the latest earnings report, and investors are pricing in very strong profit growth. The risks of over-extrapolation are significant, especially as the Fed’s most substantial tightening cycle since the 1980s will become more visible in macro data.

The elevated valuation of mainly US stocks, driven by Big Tech, is the primary reason the price reaction to usually better-than-expected earnings has been negative. More than 80% of S&P 500 companies that have reported earnings have beaten expectations.

However, only one sector, Materials (white diamond in the chart below), saw positive price action after beating expectations. Companies have made a habit of beating expectations, but with current valuations, more is needed to satisfy investors.

Moreover, the percentage of companies that exceed revenue expectations is less upbeat at 59%. The chart shows that this percentage is generally lower than positive earnings surprises, highlighting the extreme focus on (beating) bottom-line profits.

In the Eurozone, the picture price movements following earnings reports have been better, with approximately half of the sectors experiencing stock price increases. This is despite companies in the Euro STOXX 600 Index beating expectations to a lesser degree. An example of this is the consumer staples sector (purple diamond). However, investors, especially concerning food producers, expected significant future price declines, but this has not happened so far.

Outlook

With most S&P 500 companies having reported, earnings have held up reasonably well. The dominant factor here is pricing power. Across the board, companies have managed to pass on the still significant price pressures to their customers.

However, the risks to earnings remain significant. The graph below shows that operating leverage has turned negative. In other words, more revenue growth does not translate into more profits. This trend will likely continue when prices of final goods and services rise less quickly or even decline, while sticky input costs, especially wages, weigh on margins. The chart also indicates that prolonged phases of negative operating leverage are usually associated with recessions. This leads us to believe that a shift in market sentiment will cause an immediate spike in scrutiny of rich market valuations.

Sentiment

Despite the resilience in GDP growth and corporate earnings, market sentiment seems to be turning somewhat. It is still early, but with central banks openly hinting at the end of the tightening cycle, a significant pillar driving equity markets for months will fade. This leaves the hoped-for soft landing and the AI boom to push prices higher. As long as sentiment remains intact, this scenario can continue to unfold, but the pool of positive market catalysts is thinning.

Fear & Frenzy

Our Fear & Frenzy Sentiment Index remains unchanged from last week, indicating that sentiment is close to but not in Frenzy territory.

What’s up with Bitcoin?

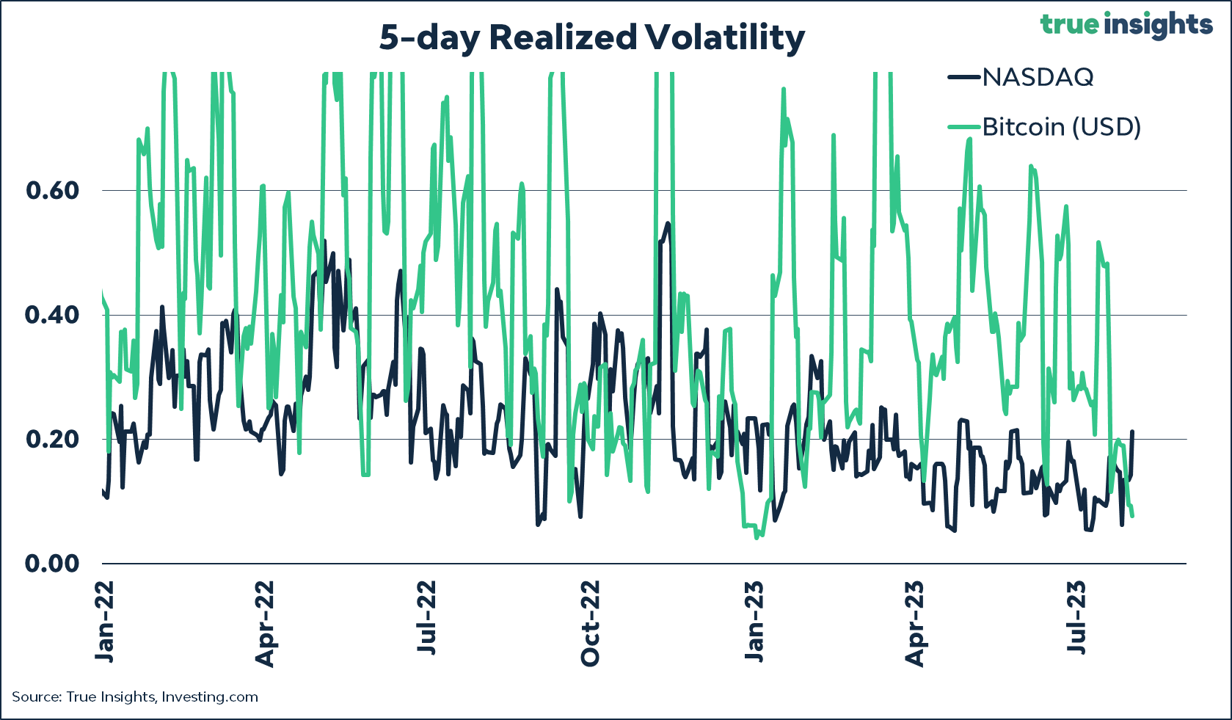

An interesting development in Bitcoin. While volatility in stock markets has increased recently, the volatility of Bitcoin has declined sharply. Measured over a very short period (5 days), Bitcoin’s realized volatility is much lower than that of the NASDAQ, often mistakenly assumed to be assets with similar market behavior.

Bitcoin typically offers more diversification benefits than tech stocks within a well-diversified multi-asset portfolio. However, with the volatility of Bitcoin usually significantly higher than that of stocks, this justifies its smaller allocation.

Markets

Active Weights

Balanced Portfolio

ASSET CLASS VIEWS

Developed Market Equities

We moved to a neutral position in Developed Market Equities. Somewhat surprisingly, central banks adopted a more dovish message bringing forward the end of the tightening cycle. Equities and Treasuries have done well after the final Fed hike. Yet, Macro momentum is weakening, and this includes the Services sector. The ISM Manufacturing still suggests ample downside risk. Our Fear & Frenzy Sentiment Index has moved deep into Frenzy, signaling the end of the current rally. Developed Market Equities are very expensive relative to bond yields.

Emerging Market Equities

We are marginally underweight Emerging Market Equities. China’s economic recovery post-COVID is far from impressive. Chinese authorities and the People’s Bank of China have pledged additional stimulus, but so far, this has done little to stop the deterioration in economic momentum. In addition, high exposure to the global economic cycle does not bode well for the asset class. And while valuation seems attractive from an absolute perspective, relative valuation measures look less impressive.

Global Real Estate

Global Real Estate continues to remain short/underweight. Commercial Real Estate remains the core focus of investors as the outlook for offices remains subdued. But with mortgage rates making new highs, the odds that housing market activity will falter again are increasing. In addition, we are at the start of a new default cycle, which to a certain extent, finds its origin in real estate. We don’t think higher yields are fully reflected in the sector and remain underweight.

Global High Yield Bonds

Global High Yield Bonds remain underweight. If anything, the outlook for Global High Yield Bonds has worsened. Lending standards remain tight, defaults are rising, yet spreads have declined as volatility dropped. However, at current levels, high yield spreads are not reflecting economic reality as they continue to price zero chance of a US recession.

Global Corporate Bonds

Spreads on Global Corporate Bonds, too, are low. However, corporate bonds offer a better mix in terms of yield and spreads relative to Global High Yield Bonds. The buffer against rising spreads has increased significantly. In addition, once the cycle rolls over – and we are not far from this happening – duration becomes a virtue again. We are neutral on Global Corporate Bonds.

Developed Market Treasuries

We are now overweight Developed Market Treasuries. Historically, Treasuries have done well once the Fed ends its tightening cycle, and we believe we are there. Second, Macro momentum is deteriorating outside the US, and the risks of a global economic slowdown remain elevated. Inflation is coming down rapidly with inflation expectations well-anchored.

Emerging Market Treasuries

Emerging Market Treasuries are somewhat of a mixed bag. Compared to US Treasury Yields, valuation is not compelling, especially when considering currency risk. Currency risk will become a structural positive once the Fed and other Western central banks are done. On a positive note, as a block, Emerging Markets require less central bank tightening, reducing the impact of duration risk. We are neutral.

Commodities

Commodity prices are being seesawed. The rising risks of an economic downturn and an impressive recovery in China pose downside for prices. This is especially the case for industrial metals. However, oil benefits from increased efforts by OPEC+, Saudi Arabia in particular, to keep prices elevated. Including supply and demand dynamics, little is needed for oil prices to pop. The upside risk in oil prices keeps us neutral on Commodities.

Global Inflation-Linked Bonds

We expect headline inflation to come down fast after summer. This makes assets with inflation protection less attractive. Also because long-term inflation expectations, which never spiraled out of control, are gradually declining. The UK budget saga demonstrated that inflation-linked bonds do not benefit from the same magnitude of liquidity Treasuries exhibit.

Gold

Gold is holding up reasonably well when taking into account the latest spike in real yields. The correlation between real yields and the price of gold is very strong and very negative. However, with the US 5-year real yield hitting 2.0% – generally seen as the level at which yields really start to bite into economic activity – the end of higher rates has appeared on the horizon. Underneath, the asset class continues to benefit from gradual de-dollarization and the search for scarce assets. We remain overweight.

Bitcoin

BlackRock’s SEC filing for a US ‘physical’ Bitcoin ETF, aiming to ‘democratize’ Bitcoin using the words of BlackRock boss Fink, has created upward momentum. Bitcoin ETFs and ETNs saw significant inflows in the weeks following the announcement. Investors are focusing on the addition of a ‘surveillance-sharing agreement’ aimed to reduce (potential) Bitcoin price manipulation. Yet, such a surveillance-sharing agreement is no panacea, and the SEC’s core objections likely remain the same. We still think it will require a reversal in real bond yields, a fresh wave of central bank liquidity, and greater anxiety surrounding the next halving for the next bull run. We are neutral.