The Weekly Market Monitor – US hawkishness, Bitcoin memes, and China's value trap

A key US Manufacturing indicator has plunged beyond(!) recession lows, yet some nuance is warranted. Bitcoin is dropping because of ETF-related selling, while Chinese stocks are abandoned alltogether.

Welcome to the Weekly Market Monitor, keeping you updated on the week’s most important charts and developments in financial markets.

The Empire State Manufacturing Survey has crashed! Only two months during COVID-19 were worse. So, how bad is it?

Other leading US macro data show little signs of recession.

Bitcoin is no fan of ‘memes’ as its price drops post-ETF hype. The reason: significant (Grayscale) selling.

China is a mess. And it just got worse. The Hang Seng Index collapsed. Are Chinese stocks a buy yet?

UK inflation added to the ‘we must remain hawkish’ narrative of central banks. Yet, many rate cuts are coming.

Sentiment is Neutral, but not for Emerging Markets.

Earnings are NOT falling out of bed - Part XXIV.

Investments highlighted: Bitcoin, Hang Seng Index, Chinese Equities, MSCI World, Treasuries, S&P 500 Index.

First things first! – The largest EVER!

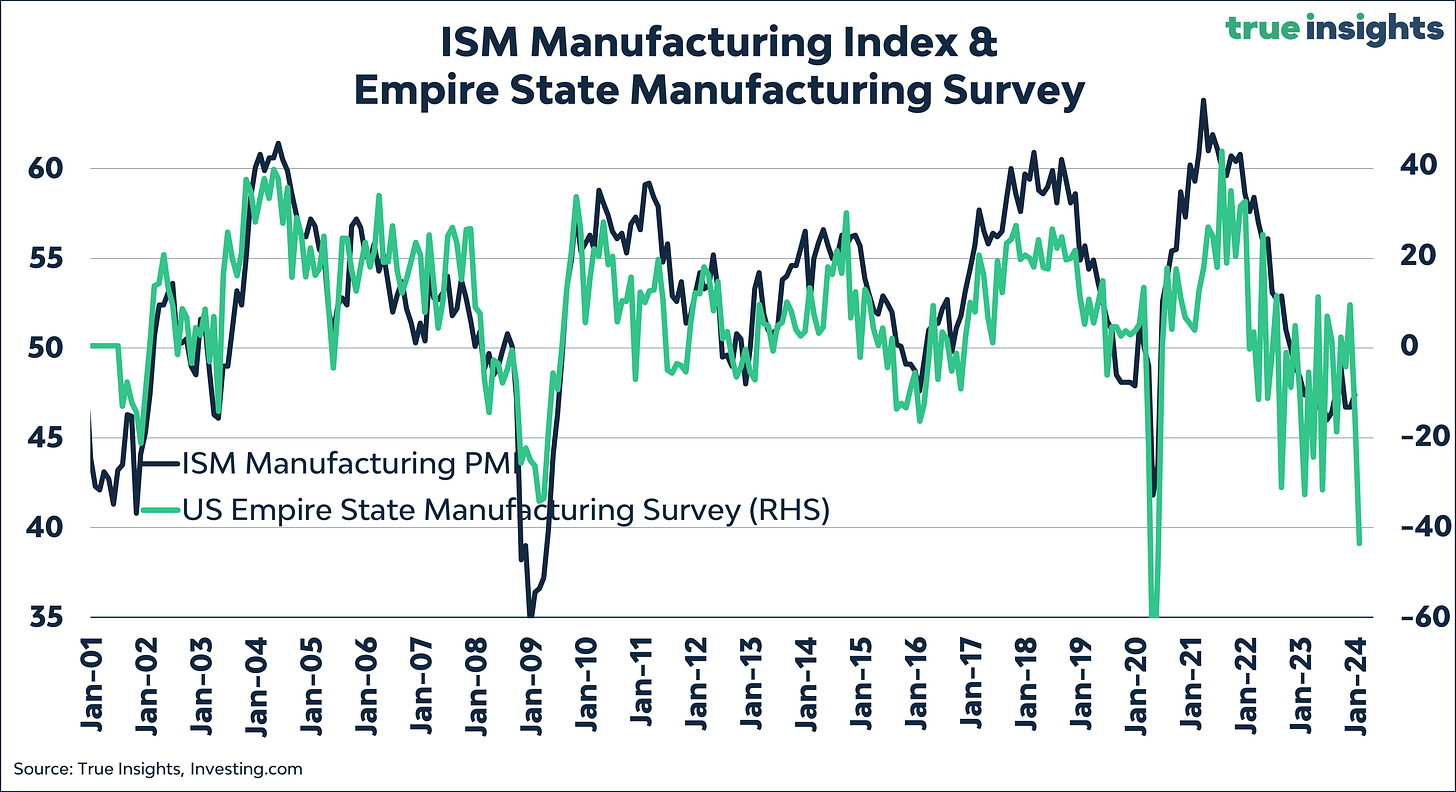

If you’re a ‘fan’ of a hard landing, you’ve been well catered to this week. The US Empire State (New York) Manufacturing Survey collapsed in January to its third lowest level on record, significantly worse than during the Great Financial Crisis. The chart below shows that the dramatic decline in the Empire State Survey points to an ISM Manufacturing below 40. Is the recession coming after all?

MACRO

Hold on a second!

Although the extreme drop in the Empire State further confirms that the chance of a hard landing is certainly not zero, the sensational headlines around the historical drop need nuancing. For instance, the sub-index for future Business Conditions moved 180 degrees in the opposite direction, indicating a rise in the ISM Manufacturing Index. I await the other regional PMIs for a final judgment. It’s not exactly fantastic, though.

Spending power

That can’t be said for US consumer spending, which continues to grow at a healthy pace. US retail sales grew by 0.6% in December, comfortably beating expectations (0.4%.) The so-called retail sales’ control group,’ excluding volatile items like autos and gas, increased by 0.8%, fourfold of what was expected. As a result, nominal and real retail sales growth is accelerating. An excellent reason to add more fiscal stimulus to an already unsustainable debt pile, don’t you think?

Oops, they did it again!

US initial jobless claims fell to 187K last week, the lowest since September 2022. For clarity, seasonality in reported numbers around the holidays is common, for example because school workers in New York can file claims during the winter if they wish. But even then, this is yet another case of ‘oops, they did it again.’ Since the beginning of last year, initial jobless claims seemed ready to spiral higher, as often seen at the end of a major tightening cycle. But after this series of Fed rate hikes, the signs of a weaker labor market remain limited.

This also means recent labor market developments are insufficient for the Federal Reserve to abandon its hawkish-sounding rhetoric. Its damaged image as an inflation fighter and the still above-average inflation figures give the Fed no choice but to stick to the ‘higher for longer’ narrative as long as possible. And that means part of the stock market gains made in the last quarter must be returned.

However, I expect the current odds of a significant growth slowdown or even mild recession to prompt the Federal Reserve to preemptively move interest rates because:

The rate at 5.50% is significantly restrictive

The disinflation trend in this scenario – barring geopolitical escalations – will continue.

Powell has made it clear that he finds achieving a soft landing extremely important, for example, by deviating relatively quickly from the 3-month Core Services CPI figures as a key inflation focus.

It’s an election year, and the Fed is very aware of the extreme debt accumulation the US is currently engaged in.

In the event of such a slowdown or recession, the Fed will cut rates more than six times. With six rate cuts, the Fed would be at 3.50%. That’s a full percentage point higher than the tightening peak of 2018 and 2.5 percentage points higher than the average since the Great Financial Crisis. If these rate cuts coincide with a classic mid-cycle dip – some recession indicators such as copper prices, residential investment, and real personal income excluding government transfers suggest that the ‘recession’ is already over – then risky assets will face another liquidity-driven melt-up. Again, this does not mean the chance of a painful, hard landing is zero.

Memes from the US

Now that the Bitcoin ETF storm has abated a bit, there’s room for a bit of ‘fun.’ Franklin Templeton, offering the lowest-cost spot Bitcoin ETF, came up with the meme below on the left. Not bad for an ‘old-fashioned’ asset manager founded in 1947.

I took the liberty of creating my take. Away with the outdated 60-40 portfolio, here’s the new and improved one. You can hardly have missed it, but alongside my research, there is now the Blokland Smart Multi-Asset Fund that invests in three scarce investment categories: quality stocks, physical gold, and bitcoin. More here and here.

By the way, Bitcoin doesn’t seem to like that Franklin Templeton post much. All the ETF-hype gains have been given back.

Where did that USD 3 billion go?

That the price of Bitcoin has dropped since its approval must have something to do with the fact that net assets have been withdrawn from US spot Bitcoin ETFs. Below are the assets under management of the newly launched ETFs with and without Grayscale, which has converted its fund into by far the most expensive ETF (fee 1.50% versus 0.19% for Franklin Templeton.)

Together, the ‘new’ ETFs brought in USD 3.2 billion, an extremely good result compared to other ETF launches. However, including Grayscale, assets actually fell by almost USD 3.0 billion. And BITO, ProShares Bitcoin Strategy ETF, which invests in Bitcoin futures, can’t explain the difference. Since its launch, USD 500 million has gone out of it, a trend likely to continue because this is an inferior product compared to a spot Bitcoin ETF. By the way, the numbers don’t add up – I use Bloomberg data – but the result is clear. Investors have sold quite a bit of ETF-Bitcoins in recent days.

A hell of a drop – stay away from China

China is no fun, either. For a brief moment, it seemed the Chinese authorities were willing to pick up their old habit and fight the ongoing plagues in the real estate sector with a mix of (mandatory) lending and liquidity. But reality proves more stubborn.

It went wrong straight from the start this week. Where a new rate cut was expected – the first since August – in the 1-year Medium-Term Lending Facility – one of the central bank’s benchmark rates – it remained unchanged.

That came on top of the slowest loan growth since records began in 2003.

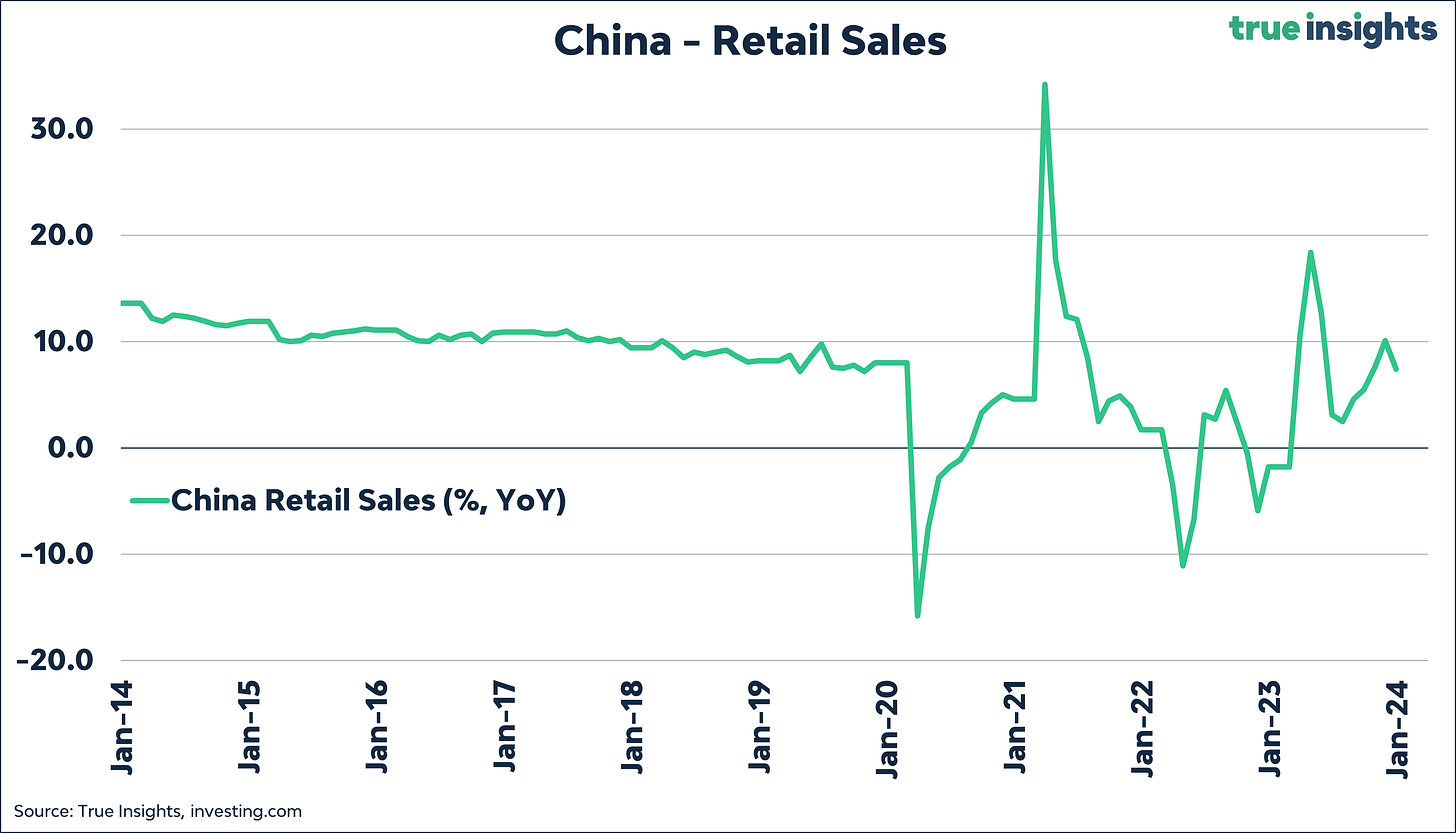

When Wednesday’s GDP growth, property investment, retail sales, and unemployment also disappointed, it was the final straw.

The Hang Seng Index, which had already started the week poorly with a 2.4% drop, plummeted by almost 4% on Wednesday, losing more after that. And although the damage to local Chinese A-shares was somewhat less, there is no sign of a turnaround.

As a result, China-Hong Kong-related stocks are almost rigidly at the bottom of the performance rankings, with a drop of 10%. And that in less than fifteen trading days.

Value trap

The question arises whether China is increasingly seen as ‘uninvestable.’ Last week, I showed that US pension funds have moved away from China. Has China become a real value trap?

In absolute terms, Chinese stocks are still not extremely cheap.

Compared to my benchmark, the MSCI World Index, Chinese stocks are cheap.

Should you buy them then? No! At least not yet. Momentum and (long-term) sentiment are negative. The MSCI Emerging Market Index (in EUR and USD) has dipped below its 200-day moving average again.

Regarding China:

‘The list of Chinese quality stocks seems small, not in the least because their business and profitability models can be ceased by authorities instantly, as we have seen recently. The argument that China is growing at a 5% annual rate does not change this (the US is currently growing at the same pace.) In addition, even if that number is accurate, it is part of a declining trend, and the quality of that growth is poor. Since you cannot create quality stocks, market leaders, or strong institutions, other, more temporal tools are needed to turn this around. Liquidity (hence more debt) qualifies, not faster GDP growth.’

UK: Recession beats CPI?

After last week’s disappointing US inflation figures – much less alarming than the headline figures suggested – this week’s UK inflation came out significantly higher than expected. As a result, global interest rates continued to rise. That’s great if you’re just buying in, but tough for existing bond investors who have already had a particularly difficult time over the past few years with negative real returns and high volatility. More on that soon.

Nonetheless, lower interest rates are on the horizon. Retail sales fell by 3.3% in December, the biggest drop since COVID-19. From this perspective, it’s illogical that the Bank of England is expected to be the last in line, after the Fed and ECB, to lower interest rates. Of course, higher-than-expected inflation plays a role, but the British economy seems ripe for a recession.

Sentiment

Fear & Frenzy

My Fear & Frenzy Sentiment Indicator remains virtually unchanged from last week and stays ‘Neutral.’

Moving Average

The MSCI Emerging Markets Index has broken through its 200-day moving average, giving a clear message: do not enter just yet!

Valuation

It’s still very early, but if we go by the first 50 companies in the S&P 500 Index that have reported their earnings, they’re not falling off a cliff.

Granted, expectations were significantly lowered in the last months of 2023 despite the rally, but, so far, most sectors managed to exceed them. Interestingly, there is a negative price reaction against it. However, this has more to do with rolling back the overly optimistic sentiment around Fed rate cuts than with company earnings. Also, our earnings indicator has been suggesting for a while that we have seen the worst.

MARKETS

Active Weights

Balanced Portfolio

ASSET CLASS VIEWS

Developed Markets Equities

The significant decline in the Fed’s inflation forecast and a dovish Powell telling markets that the FOMC is already thinking about rate cuts have been a significant sentiment boost. It also means the extrapolation of expected Federal Reserve cuts, a full embrace of the soft-landing scenario, and a surprise spike in central bank liquidity can push equity markets even higher. Yet, while some indicators are turning less negative (financial conditions, momentum, earnings), it would be too easy to sideline the signals coming from the ISM Manufacturing Index, the Credit Impulse, and declining surprise indices. Valuation is stretched even though this has much to do with only seven ‘Magnificent’ stocks. We are neutral Developed Market Equities.

Emerging Market Equities

The Chinese economy just can’t get a break as the ongoing real estate recession continues. China-related stock market indices are making new lows due to Chinese authorities forcing banks to provide unsecured loans to property developers. For a moment, it looked that China gave in and was ready to add significant amounts of liquidity (and debt) to the real estate problem to solve it. That faded quickly, however. We are getting closer to levels at which valuation starts to limit downside. We are neutral on Emerging Market Equities.

Global Real Estate

Declining bond yields have ended the bleeding of real estate stocks. Yet, concluding the asset class is out of the woods would be too early. Home prices are rising again, but this seriously hampers housing market activity. Commercial real estate looks set to deliver the next credit event as valuations have not rebalanced enough to reflect the structurally lower demand for office space. We remain underweight.

Global High Yield Bonds

Global High Yield Bond spreads have dropped to their lowest level in 19 months. This only fits in a scenario in which we are already behind the low in economic momentum, and tighter lending standards, opposite to history, do not cause a spike in defaults. Valuation of high yield bonds looks very stretched. We are underweight.

Global Corporate Bonds

Spreads are also too low in Global Corporate Bonds. Yet, performance has been strong, and Treasury yield has come down swiftly. Duration is at play here. However, at least temporarily, we expect this tailwind to vanish as yields have come down too fast. We are neutral.

Developed Market Treasuries

Even though our long-term outlook is that of structurally low yields, the recent decline looks overdone. The gap with our fair value 10-year US Treasury yield has grown among the largest in our sample. With the US economy not choking, it seems too early for the Federal Reserve to significantly adjust forward guidance and let markets run with their rate cut extrapolation. We are neutral.

Emerging Market Treasuries

Emerging Markets have already started to cut rates, which is helping performance. Anxiety surrounding Fed rate cuts means the US dollar is falling, further helping asset class performance. However, it’s too early for a longer-term decline in the USD, and the yield pick-up compared to Treasuries remains small. We are neutral.

Commodities

OPEC+ half-heartedly agreed to new but voluntary production cuts. Fewer cartel members want to adhere to these cuts as non-OPEC countries are ramping up production and stealing market share. Meanwhile, increased tensions in the Middle East cloud the outlook for oil. Copper and other industrial metals are all over the place but not in a place where they signal a recession. We remain neutral for now.

Global Inflation-Linked Bonds

Longer-term inflation expectations in the US have risen. Undoubtedly fueled by stellar Q3 GDP growth. The opposite is happening in the Eurozone, where growth has turned negative. We expect inflation expectations to have little upside as the global economy weakens. We are neutral.

Gold

Gold reached a new high as real yields started to move lower again. What is striking is that gold prices barely declined as real yields spiked above 2%. This supports our belief that the growing worries about the sustainability of debt and the ever-increasing amount of fiat currency are causing a gradual rethink of investors. We remain overweight.

Bitcoin

Bitcoin also stands to profit from the rethink on debt, yields, and inflation. Combined with the upcoming halving – the price spiked 12 months before and after the three previous halvings – and the arrival of spot Bitcoin ETFs, opening the door to a much bigger potential client base combined with the lack of supply have pushed bitcoin higher. We are long bitcoin.