The Weekly Market Monitor – The 34-year wait is over!

The Nikkei Index finally made a new all-time high. It's no surprise what's driving the recent rally, however. Monetary policy keeps all boats afloat, including Germany, which became sicker again.

Welcome to the Weekly Market Monitor, keeping you updated on the week's most important charts and developments in financial markets.

First, Japan entered a recession, and a week later, the Nikkei hit an all-time high after 34 years. Any idea why this is? I do!

I've been writing a lot about Germany becoming the 'sick man of Europe' again. Europe's biggest economy seems to seize every opportunity to hurt itself. It's baffling.

The Institute of International Finance (IIF) has updated its global debt chart. Be aware that it does NOT show the true underlying trend.

China is celebrating the new year. As a 'bonus,'' you are only allowed to trade Chinese equities if you are going to buy them. China will have a serious long-term issue in attracting fresh capital.

Bitcoin's rally is fading as inflows stutter. But what is the long-term impact of spot Bitcoin ETFs on digital gold's value? I present three key factors to take into account: two positive and one negative.

I introduce a real-time estimate of gold's market cap. Simply because most of the data you see is (more than) two years old.

My Fear & Frenzy Sentiment Index is back in Frenzy. Yet, in recent months, Sentiment hitting Frenzy has only resulted in shallow pullback or consolidation.

This and more in the Weekly Market Monitor.

Investments highlighted: Nikkei 225 Index, Japan 10-year yield, DAX Index, Chinese Equities, Walmart, Nvidia, Bitcoin, Gold, Treasuries.

First things first! - Japanese stocks hit record after 34 years

Last week, I pointed out the irony of an economy whose central bank refuses to tighten policy now plunging into a recession. This week, Japan takes center stage again in the "First Things First" Weekly Market Monitor opener, with the uplifting news that the Nikkei 225 Index has finally hit a new record after 34 years. 'Yes,' this refers to the price index, not the total return index.

MACRO

Monetary Policy – The Last Resort for Performance

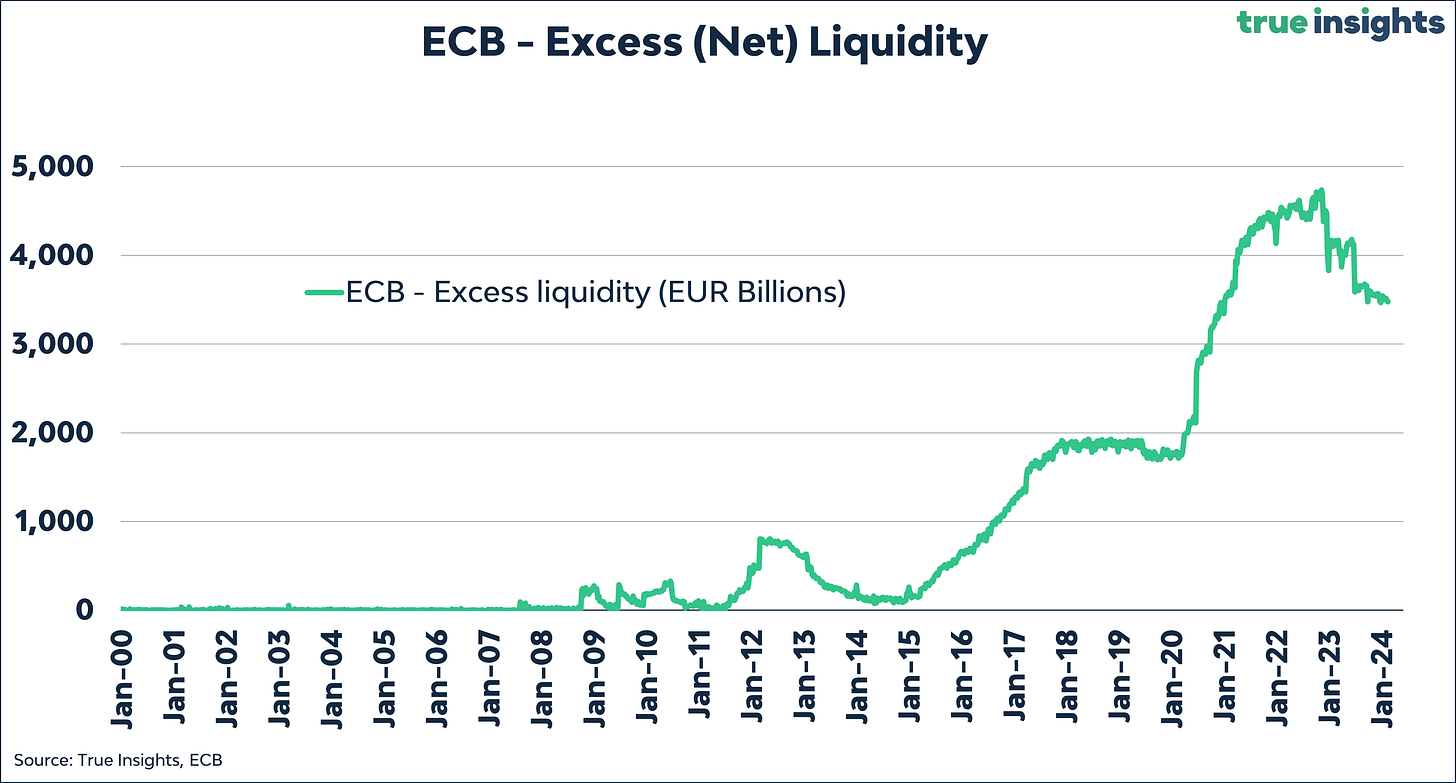

We're taught in school that the stock market isn't the economy, but that's a bit too simplistic here. The combination of a recession and record-high stock prices underscores the absurdity of current monetary policies. For context, the Bank of Japan's balance sheet equals 128% of GDP, a fivefold increase since the Great Financial Crisis.

In contrast, the Fed's balance sheet is 28% of US GDP, a full 100 percentage points lower, and even that is inflated. Central banks primarily serve financial markets – especially by keeping interest rates artificially low – while failing to control inflation.

Germany – 'Oh, boy'

It was a relatively quiet macro week in the United States. However, there's plenty of news about one of my main 'showpieces': the decline of the German economy. In one of my posts this week, I delved into how Germany has lost its status as a manufacturing powerhouse due to poor energy, climate, and regulatory policies.

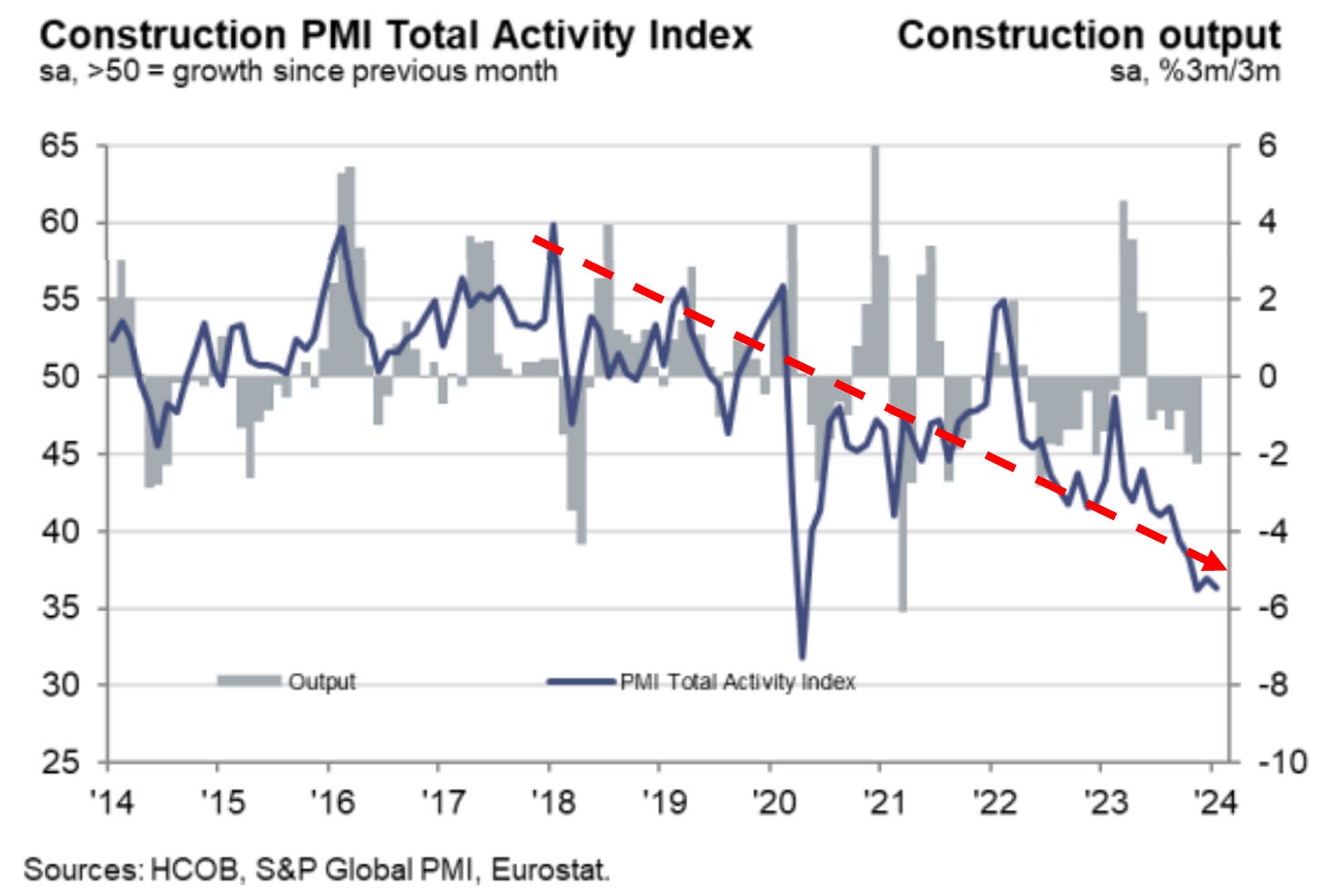

This week, the grim reality became even clearer. The German Property Federation (ZIA), the leading umbrella association for the property sector, stated that tax and regulation costs constitute 37% of total building costs. This is in a country with a housing shortage of 720,000 new homes needed by 2025. According to Andreas Mattner, Chairman of ZIA, 'Those who build will go bankrupt.' And the German Construction PMI, at a dismal 36.2, echoes this sentiment.

But that's not all. Germany's Manufacturing PMI unexpectedly fell to 42.3 in February, while France's Manufacturing PMI rose more than expected to 46.8. If only Germany had kept its nuclear power plants open.

An Irreversible Trend

In the Eurozone, we observe a troubling trend similar to Japan's. The German DAX Index is hitting new highs almost daily, driven by the massive excess liquidity from the ECB balance sheet, which primarily flows into financial markets rather than the economy. It's easy to guess what happens when the Eurozone economy truly falters.

Debt: When in Doubt, Zoom Out

The Institute of International Finance (IIF) has updated its global debt chart. Unsurprisingly, total debt has risen again, now standing at USD 313 trillion. While such a figure makes for a striking headline, it's more revealing to consider it as a percentage of global GDP, which remains just above 330%. This is staggering. Moreover, the chart's short duration hides the real trend of increasing global debt. Below is the GDP-weighted debt of the current top 10 GDP countries since 1998, based on IMF data, showing a 40% increase with no sign of improvement.

China – 'Oh, boy'

Due to the Chinese New Year, there were no macro figures from China. But to ensure that markets don't sink further in the face of limited liquidity, policymakers have devised additional rules. New quant funds will be required to report their investment strategies to regulators before beginning trading. And China has banned major institutional investors from reducing equity holdings at the start and end of each trading day.

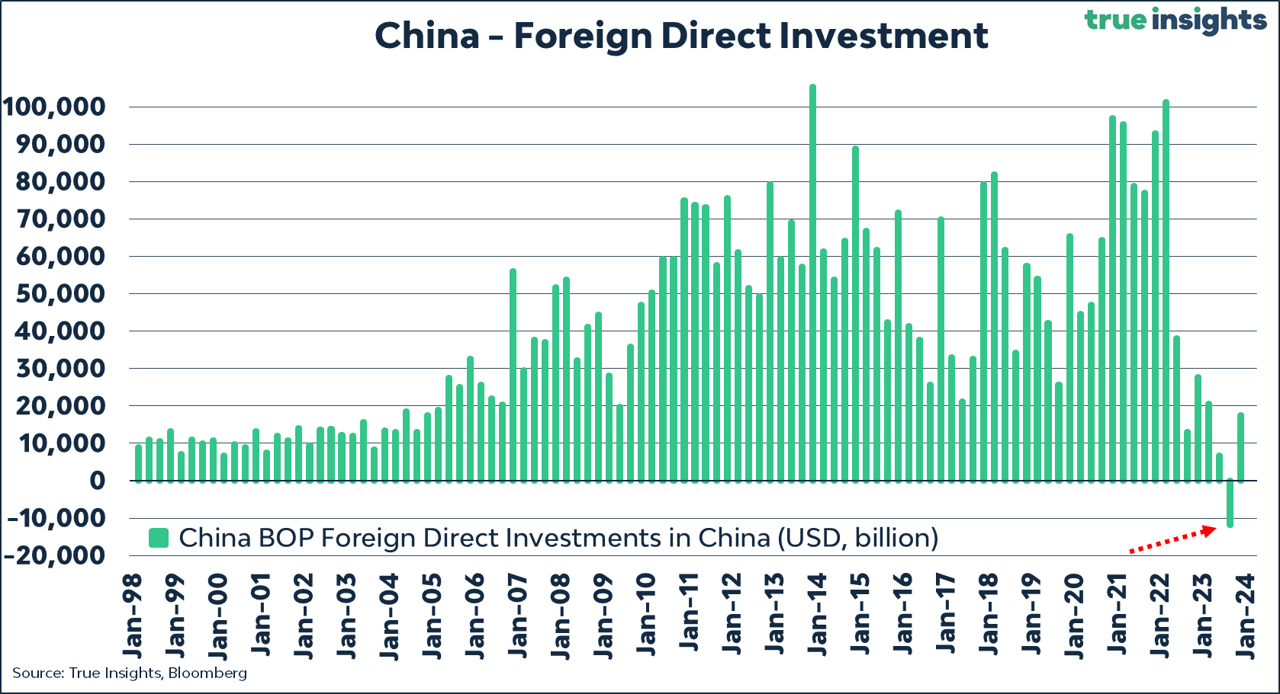

This is a classic case of 'short-term gain, long-term pain.' Investors have largely abandoned Chinese equities due to the uncertainty about shareholder rights and regulations. Measures against short-selling lead to an increase in speculators and a higher required risk premium from long-term investors, many of whom have exited. This also complicates China's access to international capital markets, essential for not falling behind in the intellectual property race.

Moreover, the 'investability' concerns about China are not only evident in the equity markets and the implied risk premium. Foreign direct investment fell to a 30-year low in 2023, with net disinvestment occurring in the third quarter.

Whether it's a housing market crisis, equity crisis, or investment crisis, the response is always lower interest rates. The 5-year loan prime rate, the reference rate for mortgage rates, was cut by 0.25%. Every major economy lacks the capability or (political) will for structural reform. Every 'solution' involves debt, liquidity, and low interest rates.

Walmart – Loss of Deflation

Amidst all the focus on Nvidia's earnings report, Walmart's eye-opener was completely overlooked. Although Walmart's CEO indicated that price pressures were moderate, the term 'deflation' was hardly mentioned.

This fits the trend observed in US CPI reports over recent months and confirms a pattern seen since COVID. Excess liquidity in the system and higher inflation are extremely beneficial for corporate profitability. This enables companies to meet strong wage growth, resulting in above-average US growth rates.

Bitcoin – Running Out of Steam

Bitcoin's relentless rally has come to an end. Just as strong inflows were a straightforward explanation for the rise, the leveling off of inflows is why Bitcoin hasn't climbed further.

Meanwhile, an interesting discussion is emerging about the long-term impact of spot Bitcoin ETFs. A few perspectives will determine the overall picture.

In stocks, bonds, and gold, ETFs roughly represent 7% of the total market capitalization of these asset classes. Here, the factor 14 rule applies: ETF market cap times 14 gives you the asset class market cap. Thus, the more Bitcoin inflow, the higher the market cap.

Almost all trade statistics confirm that spot Bitcoin ETFs are highly efficient and liquid instruments for gaining exposure to bitcoin. This means lower volatility and higher prices.

The question is, which investors will invest in spot Bitcoin ETFs? Are they speculators or long-term investors? This isn't clear yet, but given the high percentage of long-term HODLers pre-approval, it's likely that the share of short-term investors will increase first, potentially raising volatility.

Gold – A Real-Time Estimate

You might have seen it, but I've developed a real-time gold market cap estimate based on World Gold Council data and trends in the above-ground stock. Firstly, because all data I see is severely outdated. Secondly, it provides a reference for gold's actual size in the average (multi-asset) portfolio and how it compares to digital gold, bitcoin. More on this next week.

Sentiment

Lack of bears!

According to Trahan Macro Research, there are almost no bond bears left. Yikes!

Fear & Frenzy

More 'yikes!' My Fear & Frenzy is back in Frenzy after the blowout earnings of Nvidia. Yet, in recent months, Sentiment hitting Frenzy has only resulted in swallow pullback or consolidation as the soft landing - rate cuts - Big Train - has proved unstoppable.

ENJOY YOUR WEEKEND!

JEROEN

MARKETS

Active Weights

Balanced Portfolio

ASSET CLASS VIEWS

Developed Markets Equities

Strong growth, a still buoyant US labor market, and higher-than-expected resulted in markets trimming their rate cut expectations, which are now close to the three cuts expected by the Federal Reserve. Yet, more cuts are on the table, especially when GDP growth weakens. While some indicators are turning less negative (financial conditions, momentum, earnings), it would be too easy to sideline the signals coming from the ISM Manufacturing Index. Valuation is stretched even though this has much to do with only seven ‘Magnificent’ stocks. We are neutral Developed Market Equities.

Emerging Market Equities

The Chinese economy just can't get a break as the ongoing real estate recession continues. China-related stock market indices have made new lows due to Chinese authorities forcing banks to provide unsecured loans to property developers. And after some contradictory moves, China is opening the liquidity gates once again it seems. We are getting closer to levels at which valuation starts to limit downside. We are neutral on Emerging Market Equities.

Global Real Estate

Declining bond yields have ended the bleeding of real estate stocks. Yet, concluding the asset class is out of the woods would be too early. Home prices are rising again, but this seriously hampers housing market activity. Commercial real estate looks set to deliver the next credit event as valuations have not rebalanced enough to reflect the structurally lower demand for office space. We remain underweight.

Global High Yield Bonds

Global High Yield Bond spreads have dropped to their lowest level in two years. This only fits in a scenario in which we are already behind the low in economic momentum, and tighter lending standards, opposite to history, do not cause a spike in defaults. Valuation of high yield bonds looks very stretched. We are underweight.

Global Corporate Bonds

Spreads are also low in Global Corporate Bonds. Yet, performance has been strong, and Treasury yield has come down swiftly. Duration is at play here. However, at least temporarily, we expect this tailwind to vanish as yields have come down too fast. We are neutral.

Developed Market Treasuries

Even though our long-term outlook is that of structurally low yields, the recent economic strength and inflation numbers provide upward pressure. The gap with our fair value 10-year US Treasury yield has grown among the largest in our sample remains large. With the US economy not choking, it seems too early for the Federal Reserve to significantly adjust forward guidance and let markets run with their rate cut extrapolation. We are neutral.

Emerging Market Treasuries

Emerging Markets have already started to cut rates, which is helping performance. The US dollar has stopped falling, providing headwinds for asset class performance. However, it’s too early for a longer-term decline in the USD, and the yield pick-up compared to Treasuries remains small. We are neutral.

Commodities

OPEC+ half-heartedly agreed to new but voluntary production cuts. Fewer cartel members want to adhere to these cuts as non-OPEC countries are ramping up production and stealing market share. Meanwhile, increased tensions in the Middle East cloud the outlook for oil. Copper and other industrial metals are all over the place but not in a place where they signal a recession. We remain neutral for now.

Global Inflation-Linked Bonds

Longer-term inflation expectations in the US have risen. Undoubtedly fueled by stellar Q3 GDP growth. The opposite is happening in the Eurozone, where growth has turned negative. We expect inflation expectations to have little upside as the global economy weakens. We are neutral.

Gold

Gold reached a new high as real yields started to move lower again. What is striking is that gold prices barely declined as real yields spiked above 2%. This supports our belief that the growing worries about the sustainability of debt and the ever-increasing amount of fiat currency are causing a gradual rethink of investors. We remain overweight.

Bitcoin

Bitcoin also stands to profit from the rethink on debt, yields, and inflation. Combined with the upcoming halving – the price spiked 12 months before and after the three previous halvings – and the arrival of spot Bitcoin ETFs, opening the door to a much bigger potential client base combined with the lack of supply have pushed bitcoin higher. We are long bitcoin.